So with the uncertainty of the housing market, with mortgage rates going way up with inventory still being low with the FED, trying to get a grasp on inflation, but not really having a full handle on that inflation is still hurting a lot of people. And with talk of recession and where the economy’s gonna go, I mean, what should we do? Should Joe Churo just stay put? Should he keep running and not buy a house? Should Ja Marr Chase not sell his house? Well, maybe and maybe not. I’m gonna walk you guys through some more data and we’re gonna look at charts because you need to be informed about the market if you’re gonna make a wise decision. So we’re gonna give context. We are going to look at a home prices chart, we’re gonna look at annual inventory for housing. We’re gonna look at mortgage rates annually and mortgage rates monthly. And try to put it all together for you guys. Let’s get right into it.

Understanding Real Estate Home Pricing and Mortgage Rate

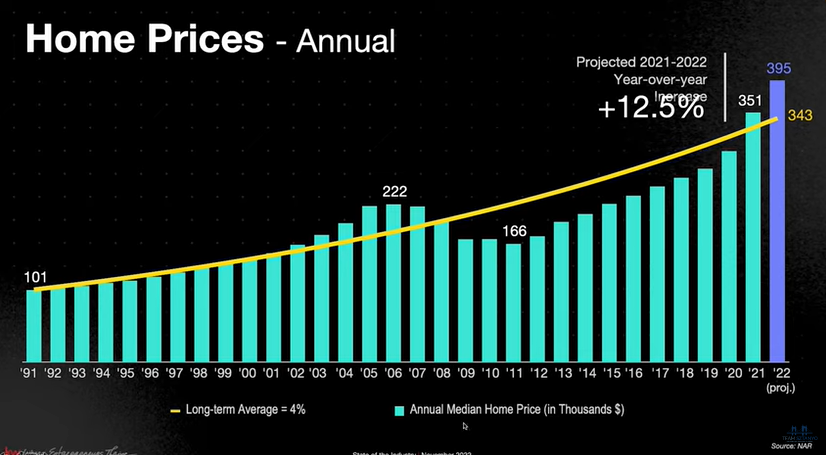

First chart I wanna look at are the home prices annual and what is the annual median home price in thousands of dollars. Looking at the time period from 1991 all the way through 2022. he Tyellow line is the trend line of the year-over-year increase of annual home prices. If you look at the projected, this chart’s maybe a few months old now, but the projected from 2021 to 2022, the year-over-year increase was 12.5% from 351 all the way up to 395.

What I think is important in this situation, looking at this, is kind of again, looking at historically we’ve seen in these last few years, housing prices going up every single year since what, 2011 to 12? So 11 straight years of housing prices going up. We may or may not see that go up this year will probably go down a little bit. But in these last few years, what you’re noticing is a huge leap from, you know, 19 to 20, 20 to 21, 21 to 22.

The other thing I wanna point out in this chart is what about when prices go down? Cause that’s what we’re hearing a lot from both buyers and sellers right now, and there’s a lot of fear surrounding home prices going down. Well, in this time period, it certainly happened, it happened in the great recession. So home prices kind of hit their peak in 06 and 07 and then they went down in 08, 09, about equal and 10 and went down a little bit more in 11 before they started climbing back. And so there’s a period about, you know 7 maybe 8 years before they went back to their actual start of what they were in 06 and 07. That’s important context to know if you are buying a house now, it is important to know that the home price could actually go down. We’ll talk about how that impacts you a little bit later.

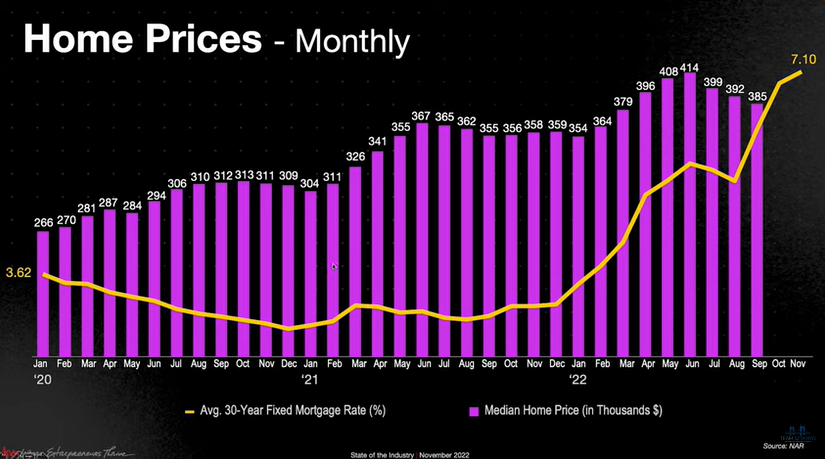

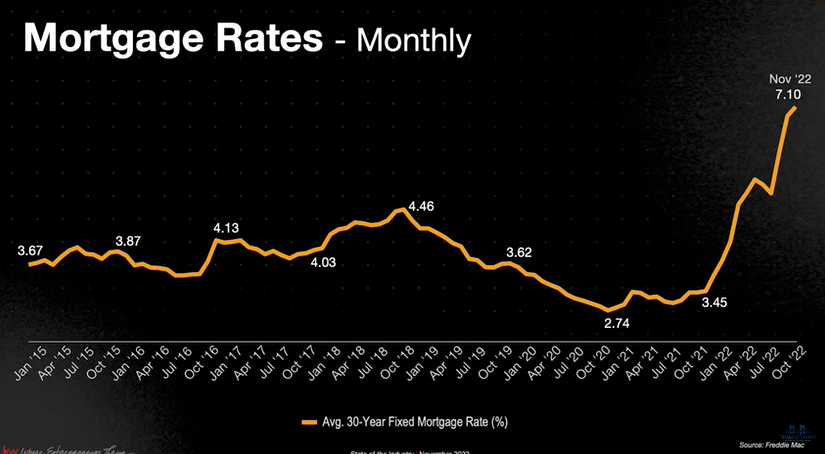

Just really quickly on this one, the home prices chart, going back the last few years, this yellow line is the average 30 year fixed mortgage rate, and you can see it’s just kind of chilling, hanging out around 3.6, even going lower than that, probably 3.5 was around average. And then right around December, January of 2022, it just started shooting up like crazy super fast. And that is what has got everything in all of a tizzy right now.

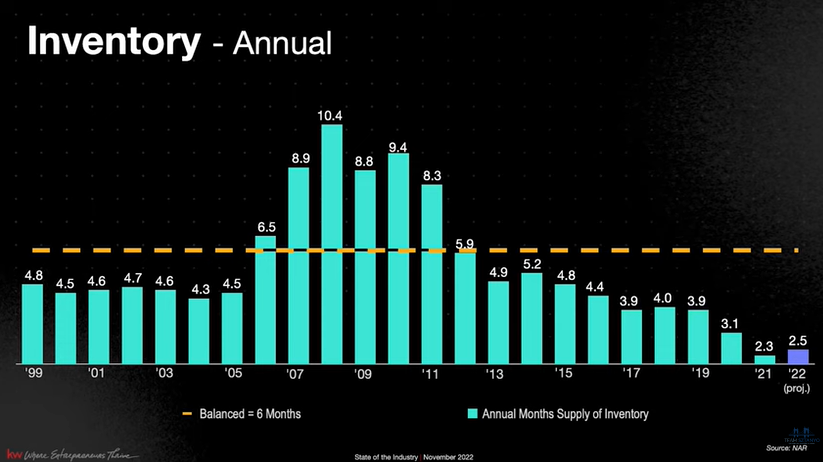

Next chart, let’s look at inventory on an annual basis, and we’re gonna put pieces all together for you guys at the end. I’m just trying to give you context right now.

So going back to 1999, you’re looking at how many months of supply of inventory do you have? Now, a balanced market is this yellow dotted line right in the middle. A balanced market means that there’s 6 months of inventory on the market. That means if no new houses came on the market, it would take six months for all that inventory to be sold. Now looking at this chart, you see back in the 90’s and early 2000’s it was a little bit under that market. So it was more of a seller’s market at that time than the recession hit and you had a lot of inventory on. So it was a buyer’s market. You had more than 6 months inventory peaking up at 10.4. So a lot of inventory, and it was hard to sell a home then. And then it came down consistently all the way through 21 and 2022, where it hit just record low inventory levels of an average of 2.3, 2.5 months of inventory in the last few years. What has that meant for you? The buyer of the seller? It’s meant a lot of demand from buyers and not a lot of supply, and that’s why we’ve seen housing prices go up so much in the last few years.

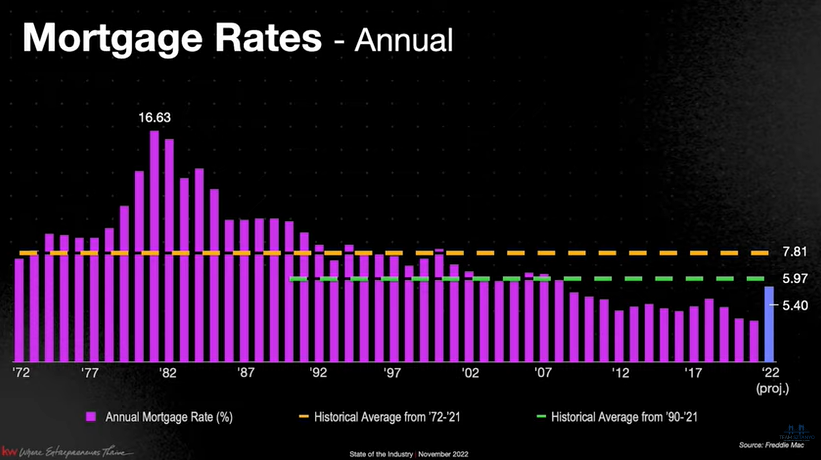

All right, next chart. Mortgage rates. This is why hopefully you clicked on this article to understand what’s going on with mortgage rates. Mortgage rates are ultimately important. If there’s a high mortgage rate, I can’t buy a house or I can’t sell a house and ah, everyone’s just kind of going crazy.

Again, let’s look at context, let’s calm it down. Yes, they’ve gone way up super fast. I think that’s what the most shocking thing is, is the fact that mortgage rates have gone up and down in the past, but they’ve usually don’t go up this fast this quickly. And the big reason why is inflation and the FED has been trying to get a handle on inflation and so they jacked up the rates much more than they thought they needed to.

Here we are, if you look at this chart, what you’re seeing going back to 1972, so this is, you know, a 50 year period looking at the annual mortgage rate, okay? And so the historical average from 1972 to 21, there was a lot of inflation in the seventies was 7.81, okay? So that’s important to think through. Over a 50 year period, the historical average for mortgage rates was 7.81, almost 8%.

If you knock out that high inflation period in the 70’s and early 80’s, and you just looked at from 1990, so this green dotted line from 1990 to 21, the average mortgage rate during that time period was 5.97. Let’s round up about 6% on average. Now, where we are right now in 2022, 2023 now is we’re closer to that average. We’re at about, in this chart it’s saying 5.4, probably right around that 6% right now, which is again, the average for the last 31 years. That was the average. Now, what’s, what’s hard for everyone to swallow is that for the last 10 years, if you look from basically 2012 to 22, mortgage rates were basically consistently going down and we were used to 5% and then four and a half and then 4%, and then three and a half when, and it was like, this is just really cheap money.

And so when you as a buyer had really cheap money to borrow, you could buy a very expensive house. Now that the rate is up, what you can afford has actually shrunk down and it feels really hard to swallow because just a year ago what your monthly payment could afford was a lot more house than you could afford right now. I understand that’s tough to swallow, but again, I’m trying to put this into historical context for where interest rates have been.

All right, final 2 charts really quick is first looking at mortgage rates monthly, going back to January of 15. And you can see they’re pretty much steady, steady, steady. They went way down at the end of October 20, 2021, and then they just skyrocketed up the last few years.

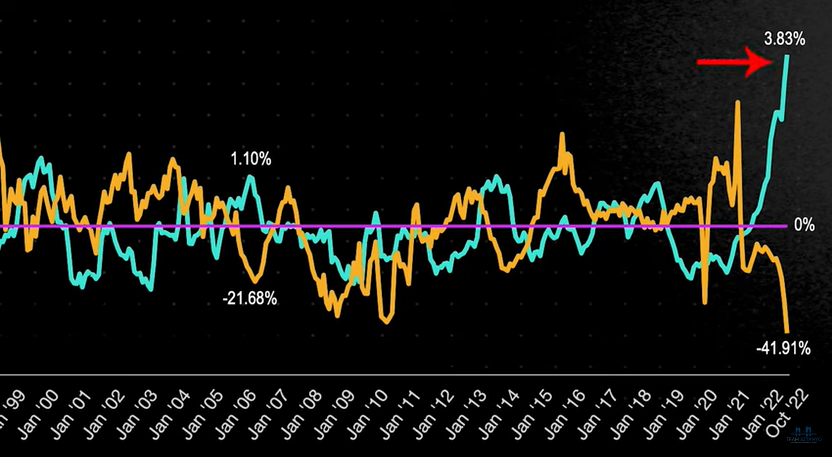

And the impact, you guys check out this correlation between mortgage rates and mortgage applications, especially at the end here of what’s happened at the end, you know, in the last year between 21 and 22, as mortgage rates have gone way up, steeply mortgage applications have steeply gone down. Cuz buyers are like Whoaa!!

Most buyers are very, very sensitive to interest rates in terms of buying a house. And the question is, should they or should they not be?

Mortgage Rate Buyer Objection and Consequences

All right, so let’s talk about real-life consequences and the kind of objections that we’re hearing a lot from buyers.

1. Well I don’t wanna buy right now cuz mortgage rates are too high. Well, we just looked at the data historically, they’re not too high. Yes, they’re high compared to last year. Yes, they’re high compared to two years ago, three years ago. They’re not high historically. They’re exactly at the average of where they’ve been historically. Should you buy a house? Maybe, maybe not. You’ve gotta not just look at only the interest rate. You also have to look at housing prices cuz housing prices have con continued to go up. So if you wait, do you think housing prices are gonna continue to go up? You’re gonna be paying more for that same house next year if you wait regardless of where the rates are. So yes, rates have gone up, but you’ve gotta put it into context historically.

2. They call me Joe Churro, they call me Joe Chisty and, I don’t wanna buy a house right now because it could go down in price tomorrow. That’s totally true. Again, that’s a legit objection. And I’m here to say as a realtor, yes, your house could actually be worth less tomorrow. No one knows, no one has a crystal ball, right? No one knows exactly what’s gonna happen. We’ve seen in that chart of home prices that home prices can go up and they can go down. What we do know about the marketplace in Cincinnati and Northern Kentucky right now is that if a house is still priced right and in good condition, it is still going to get multiple offers. It’s gonna sell within 2 days, 3 days. Still, it’s not getting the 10 or 15 offers that we saw in the summer. It’s getting maybe 2 to 5 offers if it’s in a multiple offer situation, but it’s still going at or above list price if it’s in good shape and if it’s price, right? And the reason why is that inventory is still low and we’re not getting out of that inventory problem anytime soon because a lot of sellers are hanging onto their houses because of the interest rate and builders are just still not caught up with the amount of demand that’s been there the last few years.

So you could use the objection and say, well the housing price can go down, but I wanna flip it a little bit and realize we’re coming off of a marketplace the last two years where you are bidding up against so many other buyers and we were using these things called escalation clauses in the offer, which the escalation clause is basically like a max offer feature on eBay, If you’ve ever used that where you’re in a bidding war and you say, well it’s currently at $20 and the most I’ll pay is $30 and I’ll go up by 50 cents until it gets there. That’s what we were doing with houses and it’s just kind of a crazy thing you, we use them to win. But it’s kind of crazy cuz you’re basically saying, if somebody else wants this house, I’m willing to pay more.

And that’s where we were and we were in that marketplace and now it’s like, no, there are houses out there that you can get at asking price or below where you don’t have to bid against a thousand other people because you know, they’re scared off by the interest rates and you can actually get the home a little bit less potentially than what you did in the last year or so. But Joe Churros out there, and again, this is a fictional character because he says, Hey, I’m scared again, fictional, not Joe Burrow. Joe Churro is scared and he said, Hey, I don’t wanna buy it. What if it’s, what if it becomes worth less? And I’m here to say again, that could happen, but the only time that the price of your house actually matters is the day you buy it and the day you sell it.

It could fluctuate and I’ll give you just a little personal example. A story of me, a personal story of me telling a story about me personally😂. I bought my first house in fall of 2007, right at the peak. First house was sweating bullets when I signed that contract or when I was selling the mortgage docks and then the great recession hit and my house went down in value for many years. I lived in that house for four years. I then rented it for nine more years and I then sold it.

So I made a profit on the rent for years and then I sold it last year for a big profit because I held onto it. I held onto it through the dip and then it came back up and I sold it in I think in 2021, early 2021 when price had gone way back up. So yes, your home could go down, but it’s, we’ve seen historically, even when home prices go down, ultimately they’re going up on an average of about 4% a year forever.

Mortgage Rate Seller Objection and Consequences

1. Hey, I’ve got this low-interest rate on my house, I don’t wanna sell it and then get a higher interest rate. Again, that’s a legit objection, but I would say again, it’s not all about the interest rate.

Why do you need to move? Do you need a bigger house? Do you need a smaller house? Do you need to be closer to family? Do you need to be closer to work? Yes, you might be paying more in an interest rate now, you have a higher interest rate. But you also, if you’ve owned your house currently, you probably just had a huge chunk of equity earned in the house because of all the appreciation you’ve experienced in the last few years. So the question, there’s a couple questions. There’s a math question, which is how long is it gonna take for the payment on your new house with a higher rate to catch up with the thousands of dollars of equity you just earned owning your house? That’s one question. You just kind of gotta run the math on that. Typically, it’s gonna be probably several or if not decades of years.

The second question really is are you actually motivated to move? Do you really need to sell your home? Is there a big enough reason for your family right now that makes sense for you and your situation that you actually need to sell? If so, you should sell the house and not worry about a mortgage rate.

Deciding To Buy A House Now or Later

Alright guys, let’s recap, shall we? Housing prices go up over time, they can go down, but they’re usually gonna come back up again. Housing inventory is still low, which means that housing prices are probably gonna stay pretty stable even in the current market that we’re in.

Mortgage rates have shot way up in the last year, but where they stand right now is where they’ve been at a historic average for the last 30 years. So yes, they’re a lot higher than they were a year ago, but no, they’re not high in terms of historically speaking.

So should mortgage rates be the reason why you do or don’t buy or do or don’t sell? I would say no. You’ve gotta put it into a larger context, which hopefully we did for you guys in this article.

Help Buy or Sell a House with Team Sztanyo

All right guys, thank you so much for reading! Every time you like. Every time you subscribe and join, the Sztanyo clanyo, helps me bring more of this content for you. If this was helpful today, please click the like button. Please subscribe to the channel. If you need help buying our selling in the Cincinnati or Northern Kentucky area or you know somebody who’s looking to buy or sell, give us a call. 513 8136 293. Thank you guys so much we’ll see you next time