Robert Kiyosaki said The best way to predict the future is to study the past. Today we’re gonna look at inventory, at interest rates, at Covid, at everything that’s impacted the Cincinnati real estate market, so we can be smart about our Cincinnati housing market predictions for 2023. My name is Eric Sztanyo from Keller Williams Realty and TeamSztanyo.com where we are helping you find your home and strengthen your family. I love this time of year in late December, early January, would I get a chance to kind of evaluate and look back over the last year, think about all the things that have been accomplished and then also kind of dream a little bit for the year to come and put some goals together. My wife and I have been doing this nice little three-ring binder. I’ve got financial statements and dreams and plans and a bunch of questions where we have been taking several hours, once a week here and throughout December and reviewing our last year and making goals for the next year. If you’ve never done that, go check out the guys at Abrahamswallet.com. Now Let’s get into Cincinnati housing market predictions for 2023!

Things You Need To Know on The Concinnati Housing Market Prediction for 2023

All right, the Cincinnati housing market, it’s been really strong. Sellers have been very happy the last few years, but what does that look like going into 2023? We’re gonna check out another article from the Cincinnati Business Courier and there might be a little hint because the article is titled “Don’t Get Greedy” So let’s take a look. The subtitle here is, in Cincinnati, a lack of inventory created a strong seller’s market, but ever-rising interest rates are finally requiring concessions from owners.

So if you’re looking to sell in 2023, maybe you’ve heard stories from your neighbors the last few years where they put it up, they got tons of offers and it was sold in one day. It might not be exactly the same in 2023. Let’s get into it.

Steve Eha and his wife Laura wanted to move into a new home this year as quickly as they could. “We wanted to downsize”, Steve Iha said, “and we tend to move quickly”.

The couple whose former home is on Raymar Boulevard in Hyde Park isn’t going far. Steve has been living in Cincinnati for 60 years and his new home will keep him and his wife in that same neighborhood while giving him the smaller square footage he desires. The original home is sold pending with a list price of $1.1 million.

So a pretty familiar story that we run into a lot with our clients. Older couple kids have maybe moved outta the house, had a nice big Hyde Park home in a beautiful neighborhood, but they don’t need that much square footage anymore. Want to capitalize on the equity that’s been appreciated over the last few years and sell it and get into a smaller house.

Steve Eha tapped veteran real estate agent, Julie Back of Sibcy Cline for the listing; Back has been Ohio’s top-selling residential sale sales agent for the last six years, and she’s synonymous with selling luxury homes.

Okay, just a minute, Julie, come on. 6 years top selling residential agent! Good job you’re doing it right.

The process has been a blur and it’s kept the Ehas busy. The home went on the market on a Friday, had 25 showings, and by the next day, it was under contract.

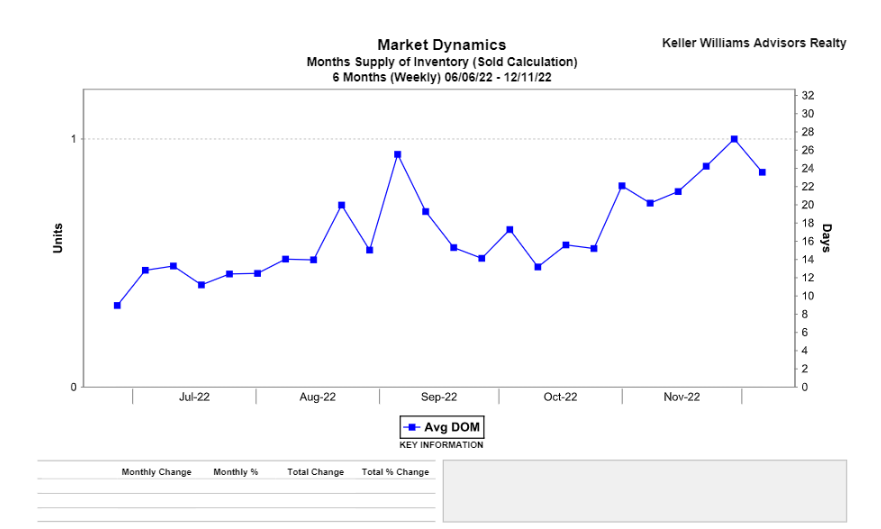

That short 24-hour turnaround is no surprise as the average days on market for homes in Hamilton, Butler, Clermont, and Warren Counties in October hovered around just five days.

Again, that’s a common story. We as agents experienced a lot over the last few years. 25 showings, multiple offers, and under contract in one day. All right, moving on.

But the fear for homeowners here and across the nation is that the days of the go-go sellers market could soon end: Interest rates continue to shoot up and a recession looms. Soon, Not every seller may have the Ehas luck.

Oh no, not every seller is gonna get 25 showings immediately and multiple offers and pick the best from all of the offers yet. I mean, that’s probably what we should expect. We can’t sustain that forever.

In Cincinnati, many real estate agents are predicting 2023 might finally be the year the other shoe drops Cincinnati likely will see a residential cool down next year, with the market returning to its pre-pandemic ways.

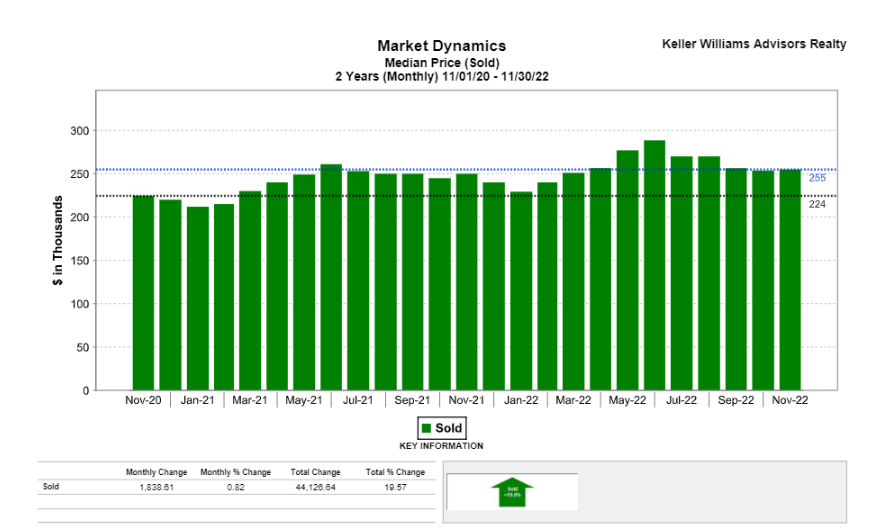

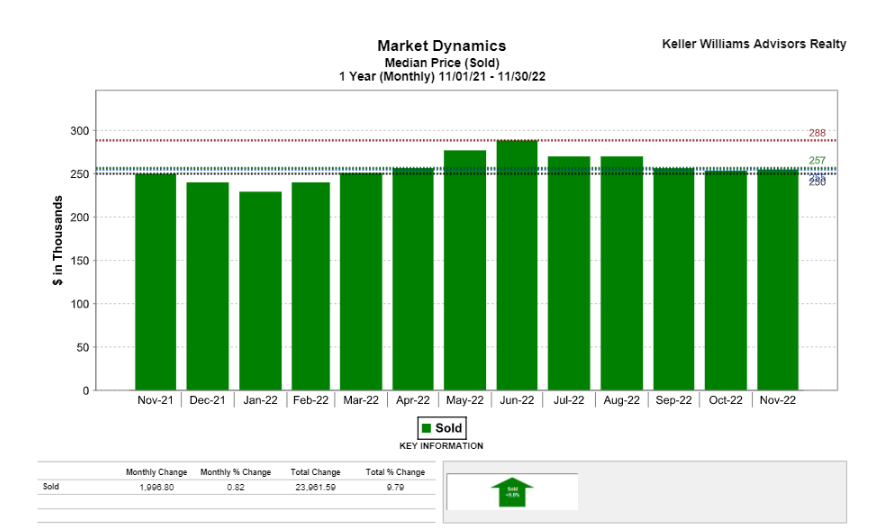

As you guys go watch our other video that we made, we’re still gonna see home prices go up. They’re just not gonna go up as much as they had the last few years. We’ve seen maybe 105, 20% total appreciation over 2021, 2022.

Data from Zillow predicts that Cincinnati will remain strong and be an outlier. The marketplace company forecast U.S home values will rise 1.2%, but the end of October in 2023 and Cincinnati, that forecast climbs to 1.8%.

So we mentioned this in the other video as well. Nationally, rates for 2023 are expected to go up about 5.4% Cincinnati at 6.1%. Part of that is just, it’s a cool city to live. We’re still affordable. And so you’ve got a lot of people leaving places like California, Texas, Florida, even New York, Wisconsin, Washington, Oregon, and they’re moving to more affordable cities. Cincinnati still is one of those cities in the Midwest where you can get a good deal on a house and still have a lot of those big city amenities.

Realizing that forecast in Cincinnati is crucial. Real estate plays a major force in maintaining Cincinnati’s strong economy.

I mean, that’s pretty much any city..

Indeed. New data from Realtor.com shows that Cincinnati home sales are expected to climb 3% in 2023 and prices are expected to rise 6.1%, making it one of the nation’s strongest housing markets.

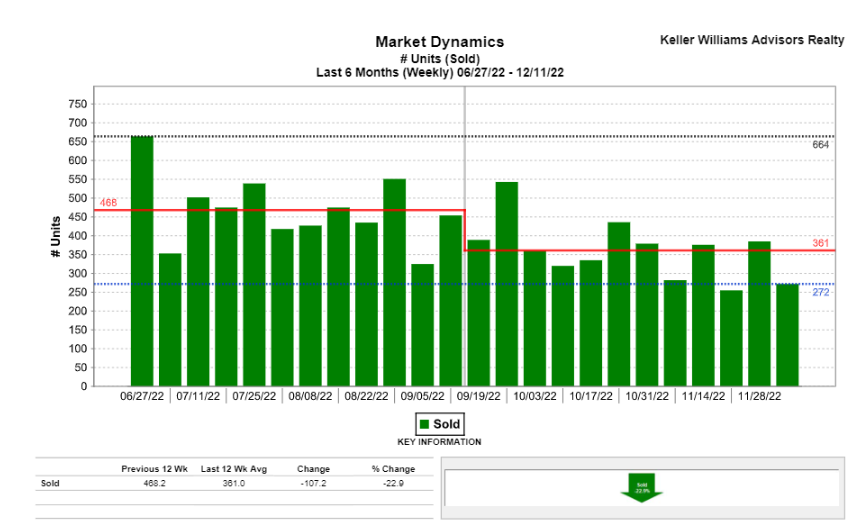

And we mentioned this in the other video, nationally, home units sold are expected to go down 14% Cincinnati up 3%, and again, it’s prices at 6.1% versus nationally around 5.4%.

Covid 19 was a huge disruptor to the local housing market. It didn’t cause a downward spiral many feared. Rather, home sales surged with Butler, Clermont, Hamilton and Warren Counties’ sales volumes reaching a peak of $800.1 million in June 2021 up from $596 million in June 2020.

I remember being in my attic making TikTok videos in early, I think it was, you know, February, March of 2020 and everything coming down from Keller Williams was like, get ready for the shift. Everything is gonna crash, and it just went the opposite way. So the last two years we’ve seen nothing but price growth and a crazy seller’s market.

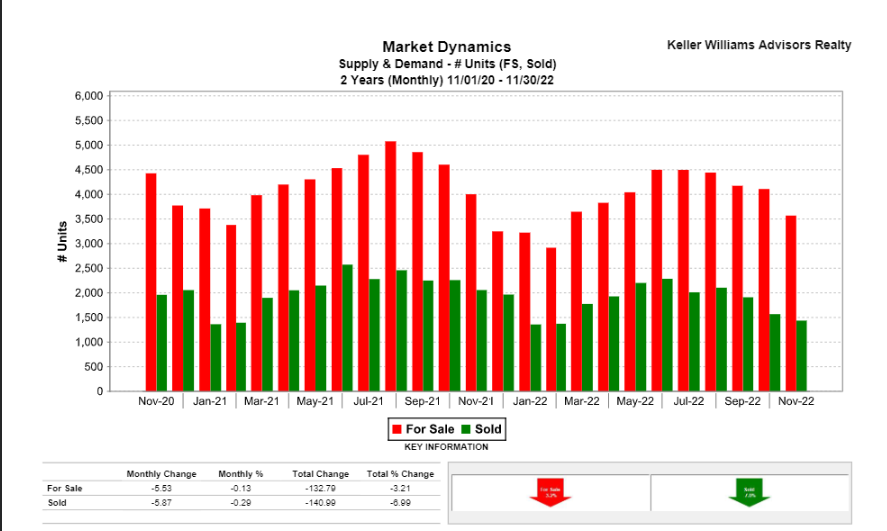

Inventory also reached a historical low. In 2018, the number of homes for sale in those four counties ranged anywhere from 2,700 to 3,700 depending on the month. In 2022, inventory has dipped as low as 940 units in February. At that level, If no new homes were listed for sale, the region would run out of homes on the market in less than a month.

We’ve been saying this kind of forever that like the inventory was kind of crazy and the reason prices kept going up, but there’s, there was just nothing to buy. Part of that was, you know, people didn’t want during the pandemic, there was a lot of fear and so people didn’t want others in their house and part of it was like, if I sell my house, then I gotta go buy another expensive one. So there were just a lot fewer sellers, but also way more increased buyer demand and just led to this low, low, low inventory with home prices going up. And if you think about that, that’s pretty hilarious. Like if no new markets came on the home in less than a month, every home would be sold. So there would just be, in the entire Cincinnati area, no houses for sale. Now a normal market is six months’ worth of inventory. If no new homes hit the market, you’ll have six months’ worth of supply. In our lowest moments of inventory, we are less than a month of supply.

“Inventory is our No. 1 issue and continues to be,” said. Robin Sheakley, president of Sibcy Cline.

In Northern Kentucky, many of those real estate market trends hold true, including the lack of inventory.

If you guys know about this channel, if you’re looking to move to the area, I talk about this a lot. Northern Kentucky has a lot of the same characteristics as Cincinnati different state, but the real estate market in general tends to be pretty similar to the Cincinnati market.

Jen Swendiman, president of Northern Kentucky Multiple Listing Service, said though inventory has grown in the past year, it’s still historically low. Northern Kentucky’s MLS was hovering around 800 listings as of November, and a balanced market would have anywhere between 1200 to 1500 homes available.

“That’s gonna continue to be the theme” she said.

Though both Northern Kentucky and Cincinnati are seeing a gradual increase in inventory, the lack of available homes has resulted in a strong seller’s market with buyers looking to snap up homes as soon as they can. Many are making concessions and putting in higher offers, which can be seen in the median price to our homes skyrocketing in both Cincinnati and Northern Kentucky over the past year.

So again, we’ve talked about that before, you had as a buyer, you just, if you wanted a house, you had to get really competitive and we helped you with that. You’re like, look, here’s how we’re gonna do this. We’re gonna talk to the agent, we’re gonna see where the other offers at. We’re gonna help you win if you really want that house. Hopefully that might be starting to settle down a little bit in the next year. And it is a little bit out there. We’re feeling that already.

Since October, 2021, the median home price in Butler, Clermont, Hamilton and Warren Counties and Southwest Ohio has risen 3.2%. In northern Kentucky, the average home price has risen over 12% from the previous year hitting $257,250 in October, and it’s $252,750 in Cincinnati.

The low inventory is in part due to what Peter Chare said, is unprecedented aggressive increase in interest rates by the federal government. That’s for sure. I mean, inflation kind of got outta hand and now the fed’s like, uh, pumping on the Brinks as hard as they can. They’re trying to do this soft landing now, which might just mean inflation goes longer. So we’ll see what happens going into 2023.

For many millennials and young prospective homeowners entering the market, they’re witnessing some of the highest interest rates in recent years, soaring to about 7.5% in November. With relatively high rates, many homeowners are holding onto their current homes, not wanting to risk entering the market during such a large hike.

Translation, sellers are like, “yeah, I know I’ve got equity in my house, but I don’t wanna sell it now because I’ve got it locked in at 3%.” So I don’t want to go buy a new house at 7.5%. I’m gonna get a lot less house. I’ll just hold onto my house. I won’t put it on the market. Inventory stays low. Prices keep going up.

Chabris said, for every one percentage point increase in interest rates, consumers’ borrowing power goes down about 10%.

So that’s a big deal. I mean, if we’ve gone up 4%, your buying power has gone down 40% in just the last six months or so. He says,

“People that were able to purchase by stretching with low interest rates are no longer in the market. “The way that we see that show up is we’re starting to see a little bit longer days on market, and we’re starting to see a little bit more negotiation – or at least concessions – from the seller. “

So while inventory is still low, you also have less buyers in the market because interest rates have gone up. So what that means in reality is instead of all these houses being sold in one or two days, some of them are on the market for 7 days, 14 days, 21, a whole month. Oh my gosh, can you believe it? And so what that means is you as a buyer, if you go an offer on that house that’s been sitting on the market for 30 days, you’re probably not competing against another buyer. You can put in an offer at list price or even below list price. You can have an inspection. You don’t have to sell your first kid to buy the house. It’s like incredible. And sellers, you gotta be realizing this like because you’re not getting what you were getting back in June, July, August of this year. It’s just not happening.

Agents agreed that even though a7.5% interest rate is historically low, it’s unprecedented for younger generations, especially those who have witnessed such a unique market during the pandemic.

Swendiman says,

“I get frustrated when agents (say), back in my day, rates were 10%,'” She says. “That’s fine, but they haven’t been for 10 years. We have a whole generation of buyers that become quite used to interest rates that are 2.5% to 4%.”

So you’ve got these people, these agents who have been in the market a little bit longer and have seen higher interest rates, and they’re like, they’re still low and swink saying like, yeah, they are low historically, but for someone who’s for the last decade seen them at 2.5% to 4%, they’re in often cases more than double than what they were. And that’s a significant amount of buying power that you’ve just lost. It’s no small thing that the interest rates have gone up so much.

With days on market increasing, as inventory starts to climb, that seller’s market is slowly beginning to shift. The rate hikes should eventually lead to a balanced market. Chabris predicts the Cincinnati market will end the year with about 2.5 months of inventory. Cincinnati will still be a seller’s market, but it will put 2023 in a flexible position.

So as we mentioned, a balanced market is 6 months. We were at less than 1 at the end of the year. We might be around 2.5. So it’s becoming slightly more, buyers are getting a little bit more power, but it’s still a seller’s market.

“It takes a little bit of time for these things to work their way through the market,” Chabris said.

Swendiman said empathy is crucial as rates continue to fluctuate in in the market shifts. How resilient buyers and sellers are to changing rates and other market factors can vary not just by market, but by neighborhood.

Our strategies might be different, but let’s figure out what you need, and let’s figure out the best way we can make that happen,” she said.

This is a great point, and this is what a good real estate agent should do for you. Help you navigate all this craziness, all the shifting in interest rates and understanding different markets, understanding different neighborhoods and understanding what are your needs, what are your wants? Do you have to be in a house right now because your job is starting in a month or do you have time to wait? Do you have a baby coming? There’s all these different factors that are specific to your individual situation, and a good agent is gonna ask you the right questions, gather the all of the information, and do what’s best for you.

Despite market uncertainty, agents overall shared a positive view of what could be in store for the next year.

Julie Back predicts the top of the market will continue to hold strong. She said homes are still selling for asking prices or above, and that shouldn’t change going into the next year.

So if you’re in that higher end market, maybe 1 million or above, what Julie Back who sells a lot of those houses is saying is that market’s still holding strong. So if you’re more in the luxury market, don’t look for huge discounts on those prices. They’re still kind of holding their own.

“I think the spring market will be extremely fast moving,” Back said. “Cincinnati is very upbeat and continuing to grow.”

and I’m telling you right now, you better get here before we win that Super Bowl, then everyone’s gonna jump on the train. Everyone’s gonna be here, prices are gonna go way up. I mean, you got a few more months.

Swendiman said the Northern Kentucky market is in a period of growth, which will bleed into next year. She predicts the days of market will flatten in addition to home prices leveling off.

Chabris said by no earlier than the end of the first quarter of 2023, the market may reach some sort of equilibrium.

So all of them are kind of saying it’s slowing down. It’s becoming more of an equal market towards the first quarter of 2023.

Swendiman and others stressed despite this period being a “slowdown,” It’s not a true regression- it’s the market recovering from the explosion of activity during the pandemic.

So again, a lot of people still have in their minds, oh, it’s gonna be like 08 or ,09 and the bottom’s gonna fall out and home prices are gonna drop. If you’re thinking about that, you might miss the boat because what we’re seeing is not a drop in prices. What we’re seeing is a slowdown and getting back to more normal appreciation than what we saw in the last few years, which was a little over 10% each year.

Swendiman says, “The growth that we had over the last few years is not healthy or sustainable in any sort of long-term prospect,” she said. “We’re adjusting from that back to just kind of reality…I don’t find this to be an alarming trend. It’s just getting back to the kind of speed and pace of how real estate happens.”

During the pandemic, many homeowners did home improvement projects and tapped contractors to work on their homes. Sheakley said. Homes in the area are appreciating at a rapid rate, Chabris said, even as the market slows. Because of that, many homeowners have more equity at their disposal when entering the market.

So there’s another point to consider here is people have a lot of equity in their homes, not only because of the appreciation over the last few years, but also because they spent the last few years during Covid doing these home improvement projects, which also increased their equity. And a big, big reason why the market crashed in 08 is you had all these people with zero equity in the homes, and then when the prices dropped, they were upside down. They had no equity pulled from and they got foreclosed on. They had to sell the house.

The bump in equity is now the biggest talking points agents have Sheakley said.

With the likely return to a pre-pandemic market, some agents think it’s possible their colleagues might leave the field. Agent numbers tend to fluctuate with what is going on in the market, and the first quarter is typically a time where some agents might retire, exit or even enter the business, Swendiman said.

“Any time you have a shift in the market.. history has proven, some people get out,” Sheakley said.

okay, so that’s a little bit more agents speak, but you had a lot of people become real estate agents in the last few years, and when there’s a shift, meaning maybe less sales overall, what happens is the agents who have more market share get more of the sales and the agents that have fewer market share, they don’t have enough business to keep going.

Speaking of which Team Sztanyo continues to grow, if you’re interested in joining the team, give us a shout. We’re always looking for talent to join the team.

All right, final point of this article says,

For those trying to sell their homes in 2023, Steve Eha has some simple advice: “Don’t get greedy.”

If you guys have hung in this long to the article for The Cincinnati housing market predictions for 2023. Thank you!

Understanding The Cincinnati Housing Market Predictions for 2023

Let’s put a bow on this thing. Interest rates are going up. It’s causing some buyers to get outta the market, but it’s also causing some sellers to not want to sell. Overall, the market in Cincinnati is cooling though predictions for 2023 still have home prices gonna be going up at about 6%. Overall predicted for the year. If you’re looking to buy next year, you can expect interest rates to still probably go up a little bit. However, because the days on the inventory’s growing and the days on market is growing a little bit, you might have a little bit more buying power. You might get the seller to come down on their price or get some seller concessions when you offer on the home. If you’re looking to sell in 2023, then you might want to take this advice from Steve, who we started this video with who sold his Hyde Park home, and he said, for those looking to try to sell their homes in 2023, I have some simple advice. “Don’t get greedy.”

All right guys, that was a deep dive into our Cincinnati housing market predictions for 2023. If this was helpful for you, please like it, and subscribe to the channel. Comment below If you’re looking to buy or sell in 2023, or you know someone who is, give us a call at Team Sztanyo, we would love to help you or whoever you’re gonna refer to us, (513 813-6293. Thank you guys so much! It’s been an amazing year. The channel has grown tremendously. I haven’t said this much on the channel, Booz by far our biggest year here at Team Sztanyo. And so much of that is because of you who watch, who subscribe, who reach out to us and choose us as your realtor. So thank you for that. I hope you have a very merry Christmas and a happy New Year. Thank you guys so much. We’ll see you next.