If you’re looking to buy a house in Cincinnati, Ohio, or Northern Kentucky, you might be trying to figure out which this place is more affordable. Is it Better to Live in OH or KY? As a licensed real estate agent for both Ohio and Kentucky. I get this question a lot and it’s not as simple as you might think. So let’s jump into it. My name is Eric Sztanyo from Keller Williams Realty and team Sztanyo.com. Where we are helping families find their homes and strengthen their families. We love helping people who are moving to the Cincinnati area or Northern Kentucky area. By that, the most asked question is – Is it better to live in OH or KY? And that’s what we will be talking about.

Why Families Are Choosing To Move in OH and KY

I’ve lived here for 30 plus years. I’ve lived on both sides of the river and a question that I get a lot from people who are moving in is “which one is more affordable.” First, let me back up and say, “if you’re moving to Cincinnati, maybe you’re relocating for a job, whether it’s P and G or maybe the hospitals or the university or manufacturing job, you might not realize that Kentucky is actually just on the other side of the river.

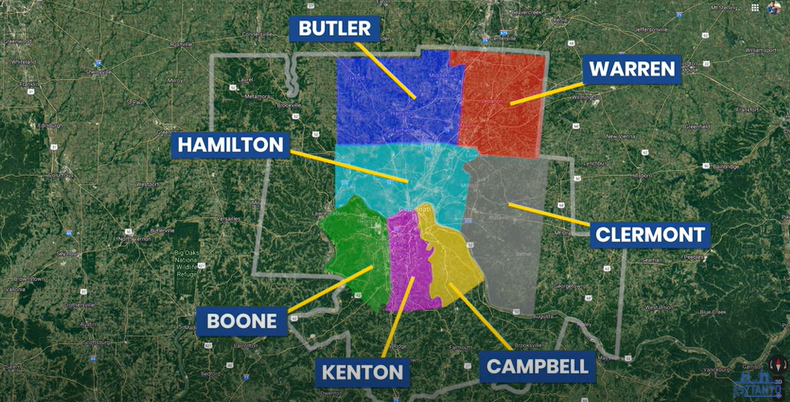

The Greater Cincinnati Metro area is composed of really three states. It’s a tri-state area, there’s Ohio, Indiana, and Kentucky all coming together. Cincinnati and Ohio, and the counties around Cincinnati Hamilton, Claremont Butler and Warren counties make up about 60%-70% of the population. And Northern Kentucky is probably that other 20% -30%. So the three counties of Boon, Kenton and Campbell County in Northern Kentucky, kind of makeup that Metro area of roughly 2.3 million people in the Cincinnati Metro.

I moved with my family to Cincinnati in the late eighties, we lived in Michigan.

And we came down with the airport. The airport was really expanding. My dad was a pilot and Cincinnati was a hub for his company, which was Delta airlines at the time. And what I didn’t know when I moved here was that the Cincinnati airport is actually in Northern Kentucky. And I was like” what? Why is it Cincinnati, Ohio airport in Kentucky?” Well, the two areas are kind of blended, but they’re also different.

And so that applies to taxes that apply to the cost of living. I kind of want to walk through that with you and see which one might be more affordable and there are some nuances in it that are just not a simple answer for everybody. In the end, it’s ultimately about the same on either side of the river that you live. So when I’m usually answering this question to people, I’m kind of like “it’s about the same. It’s probably more about where you want to live your commute, things like that, different neighborhoods you want to live in, but let’s jump into it.

First of all, I want to start over on this Tri-ED website, which is a great resource. If you’re moving here in Northern Kentucky, it’s more, maybe a little bit for businesses but it gives you a lot of good information. One of the things just on the top level, says “Northern Kentucky and Greater Cincinnati offer an unbeatable quality of life, uplands, urban, suburban, and rural amenities to every lifestyle.”

One of the things that are really cool about living here is you can be downtown, you can have the art scene, you can have great restaurants, you can have professional sports, you can have ballet and the symphony and concerts, you can be in rural farmland and then you can basically head out any direction you want in about 20 minutes. So you kind of has the best of both worlds here in this size of a city.

Housing –“Northern Kentucky, and Greater Cincinnati offer all types of housing from urban lots, single-family homes, and historic neighborhoods, newly constructed, some bourbon homes and rolling farmlands.

So whether you’re a young professional and single, or whether you have a large family. There’s any kind of housing you want here which is really nice. The housing prices in Greater Cincinnati are 25% below the national average, which is great. The commute times on average are 22 minutes. So you can get basically anywhere in the city really fast, which is nice. We’re not overpopulated here, and then in terms of cost of living, it’s about 12% below the national average. So that’s awesome.

Amenities– You have professional sports and teams, a great park system, museums, theaters. There are always festivals going on the October Fest. There’s the flying pig marathon, which is a big deal. You have the opening day parade, which is always an annual big deal for the Cincinnati Reds.

There’s always something going on. We have events for every lifestyle and age group. Greater Cincinnati is frequently recognized for its numerous expansive parks, culinary scene, breweries, which I really like both sides of the river. You gotta check out Braxton Brewery, Mad Tree Brewery, 50 West brewery, Rheingheist which is in Over the Rhine. And distilleries. So don’t forget the Bourbon trail that’s in Kentucky, we’re famous for our bourbon. Those things are very fun and year-round family-friendly attractions, and as a father of five young children, I love that there are so many different things I can do in the city. Whether it’s in Northern Kentucky or Cincinnati.

How Taxes Works is Ohio and Kentucky

You came here for taxes and cost of living in each so you can have an idea if is it better to live in OH or KY- So let’s dive into that. I wanted to show that it’s really hard to find a good resource about this. And I asked different realtors in my office “Where do you go in terms of helping people with their taxes?” And a lot of people said “just the county auditor website is very helpful” which is true. You can go on the county auditor websites, both in Cincinnati or Northern Kentucky, and get the property tax.

But there’s more to it than just that. And I found this thread, which it’s a few years old on citi-data.com. But there’s a lot of good information on here. So I kind of want to walk through it and help you understand. As I said, the different nuances of what it’s going to cost you to live, whether in Cincinnati or Northern Kentucky.

So here’s kind of the title of this thread –Cincinnati versus Northern Kentucky taxes, Hamilton Fairfield, real estate, car insurance credit. It’s all kinds of factors in here.

From mulaman984 says “Hey, I’m relocating soon to the area I’m still deciding between being downtown (CBD, OTR, etc) vs Newport or Covington. I’m trying to understand the difference in taxes. Ohio has a lower income tax than Kentucky (by about 2%), but Cincinnati has a 2% city tax. So in the end, is it a wash between both locations when comparing taxes?”

So this is a good place to start. If you do look at the state income taxes, Ohio is a marginal rate and generally, it’s cheaper and Kentucky’s maybe a little bit more. And so that’s one place to start. If you are an employee and you’re getting a W2, that’s something you might want to consider in terms of the state taxes, or if you own your own business. But that’s one thing to factor in here.

Then at the same time, Cincinnati has this 2% city tax. And so it’s like “oh, okay, I’ve got cheaper state taxes, but I have this 2% city tax, which kinda adds up.” Obviously, there’s a lot more to consider than just taxes when it comes to choosing a place to live. But I was just wondering, which is a better deal when strictly looking at taxes?”

As we go down here, people give some good insights. So I thought it was helpful just to share with you guys and you can kind of make the decision of whether is it better to live in OH or KY.

So JayLawrence01 says a couple of things. “If you’re working in the city of Cincinnati, where you live as a moot point, the 2% is charged to anyone who works in the city, whether they live there or not.” So you could be living in Northern Kentucky, but if your work is in Cincinnati, you’re still going to get charged at 2%. “If you’re relocating to Cincinnati with an existing employer, generally the best person to ask is the person doing the payroll for the company, as they can tell you the tax and withholding rates.”

So that’s a tip for you guys if you want to decide if it is better to live in OH or KY. If you are coming here with a job, ask your employer, asked the payroll person like”Hey, what are the taxes going to look like? Does it matter where I live?” They’re gonna be able to give you those good answers and current answers. “In general, I would say Kentucky. So in terms of better cost of living, but you have a specific situation. So you need to do your research. Ohio is a high tax state. And if you have the misfortune of living in one community with the city income tax and working in another city with an income tax, you will find yourself preparing tax returns in both cities and potentially paying taxes in both cities.”

This is true and as a realtor, I actually have to do this in Northern Kentucky, in multiple cities. And so if I sell a house in Covington and Florence and Union and Fort Thomas, I’m paying taxes basically in all of those cities. So there are multiple things to find out here, more than just the property taxes and more than the state income taxes.

“If you’re running your own business, you can set it up and work in an unincorporated area like Anderson and pay no city income tax.”

So this is a key tip I wanted to point out. I actually did live in Anderson township. For a lot of people, it’s kind of hard to understand, but in the greater Cincinnati area, you have cities, you have counties, which most people are used to. And then you have this middle municipality, which is a township, and there’s a lot of different townships. And in Anderson township, for example, which is on the east side of the city. You could live in the city of Cincinnati and so you might be paying the city of Cincinnati tax, or you could be living outside of the city limits in the township. And the township is going to provide some municipality services for you. But the taxes are going to be different. And so a lot of people try to live just outside of the city of Cincinnati limits in these different townships- Union township, Batavia township, Anderson township, and then might be able to save a little bit of taxes on doing that. And so if you’re gonna live on the Ohio side, that’s something you might want to consider. In Kentucky, there aren’t any townships, it’s just the county and the city level, but in Ohio, you have these kinds of spots where you might be able to live outside of the city of Cincinnati limits. And if you’re not working in the city of Cincinnati, you could save some money that way.

The guy who started this post – Mulaman984 Said “Thanks for my research! Ohio and Kentucky are reciprocity states, meaning since I’ll be working in Kentucky, but living in Ohio, I simply fill out a form and my employers should not withhold Kentucky taxes. I’m not sure if they’re set up, to be able to go in and withhold Ohio.”

jlawrence01 says “I’ve done payroll for multi-state sites in St. Louis, Missouri, and Chicago, Illinois. If you live in Ohio and working in Kentucky, your employer will withhold and remit the taxes to Ohio, where you will run into issues is that you may owe taxes in the city that you live. In general, Kentucky employers do not withhold that. You’ll need to research that and see what your resident’s city requires.”

So if you’re living in Ohio, you work in Kentucky, like I said, you might need to pay taxes in that Kentucky city, but your employer might not withhold those taxes. So come tax time, you might find that you owe the city some taxes. It’s going to be a very low percent, but you, you don’t want to be surprised by that. So again, it’s saying, make sure you’re asking that payroll person.

Sky says “I’ve worked, lived in eight states. And I found that Ohio and local taxes are the most confusing and unduly complex in your situation. I would live in Kentucky and not deal with the hassle.”

So this is why it’s not just an easy answer to give to people. It’s like, it’s complex where you’re living and working, and it’s all kind of mixed and you’re not really sure. So you got to kind of ask these questions specifically to where you might live and, uh, where you might work.

Ghostrider7811 said “I’m being transferred to Ohio from work. The office is in Mason. I work in the field and I barely go to the office. I’m looking for a house using Mason as ground zero. The property taxes appear to be much higher in Ohio versus Kentucky. This is just comparing like houses”

I would say that’s probably true in general, the property taxes are a little bit higher in Ohio, but that’s not the whole story. So don’t base your solution only on that.

“I did read about folks working in Kentucky but living in Ohio. I’m thinking the opposite. Living in Kentucky and working in Ohio. Most of my territory is North of Cincinnati. So if I live in Kentucky, it would add to my driving time by 50 minutes or so. Are my tax findings true? ideas and suggestions are welcomed! By the way, I have one kid in public school, fifth grade, and two other kids taking college online. Thank you much, Jim.”

Sarah jumps in, says “I share your overall impression that property taxes are quite a bit higher in Ohio. It’s hard to figure closely because a lot of property taxes are based on what goes to the local school district. So it can vary quite a bit from district to district alone.”

So if you are in Mason schools or a Lakota East or West school district, or Sycamore schools in blue Ash, something like that. Your property tax might be higher than if you’re living in the Cincinnati school district. Cincinnati public school district, which has a lower property tax. So make sure you’re checking on the school district.

“When what gets next to impossible is figuring the overall tax burden for any given individual between the two states. Mason has a range of housing prices and a very well-regarded school district. And in your place, I’d certainly look for a home there. Your driving time estimate is possibly reasonable but doesn’t factor in the ginormous tie-ups that happen frequently. Anytime there’s an incident on the interstate or even bad weather.”

So if you’re deciding if is it better to live in OH or KY and you’re trying to like do the math. And you’re like, well, I could get a cheaper place in Kentucky and I’ll just commute. but the one interstate you really want to try to avoid if possible, or the one bridge I should say is where I-71/ I-75 crosses the inner, the Ohio River, right on the west side of downtown. They cross what’s called the Brent Spence bridge, which is functionally obsolete and has been for like 20 years. And there’s so much traffic that bottlenecks in that one spot because those highways connect Michigan down to Florida and other places in Ohio and Pennsylvania. So there’s all this cargo and trucks going through there. And so if you’re living on either side of Ohio or Kentucky, if at all possible stay kind of on the loop of I2-75. If you need to transfer from one way to the other or the I4-71 bridge in Northern Kentucky is the Big Mac bridge it’s called the big yellow bridge. If you ever see it, cause it looks like McDonald’s and the golden arches- also move really well. So cost is one consideration that commute times are definitely another, and that Brent Spence bridge is going to cause you to pull your hair out. That’s the one place where traffic is always bad all the time.

“To me, it’s a commute. So no sane person would sign on for if they had an alternative by a little bit less expensive house in Ohio and spend the time you’d otherwise spend communion with that fifth grader. That’s really good advice. They’ll thank you for it.”

So yes, you might be able to get a little bit less house in Ohio for that same price in Mason, but 50 minutes a day that you get to be with your kid and your wife – that’s a really good point by Sarah. So good on you Sarah Perry for giving that advice.

So Jay Lawrence says “I have a few ideas. First real estate taxes for every property in Hamilton County is available online. If you see a house that you’re interested in, go to the county recorder’s website and look at the recent tax data, Kentucky probably does the same. You cannot rely on the MLS data.”

As a realtor, I can speak to this, that this guy is right. Like most realtors are not going to take their time to look up the county tax info and make sure it’s accurate. You should be doing that. But most realtors are just trying to sell a house or get their clients to buy a house. And so they might put something like the tax info. They’ll just say it’s off the record, which means I’m too lazy to look that up. And so they’re saying you go look it up. And also they might be putting something in where they’re copying from a previous listing or something like that. So always verify that information in terms of the taxes. This person is absolutely right.

“Second, when your search is down to two to three municipalities, call your friendly payroll person to determine the local income tax rates for the community. You’re interested in. In Ohio, many cities, levy an income tax on both residents and non-residents who work in that community. There’s occasionally, but not always a tax credit. If you’re working in Mason, you will pay local income tax in Mason and get the community you live in to get around that live in Mason, or live in a town or city without an income tax or live in an unincorporated township area like Anderson. (That’s how you can save a little bit on taxes.) Most of my friends over the years have migrated from the city of Cincinnati to Anderson or Kentucky. And the two reasons are taxes and schools.”

So Anderson has great schools. I was just showing a buyer from out of town yesterday. They need to be close to work. He’s going to be working at Cincinnati children’s hospital. He needs to be within 30 minutes of that. And so we were trying to look at school districts. We were looking at Marymont Madeira, then we went over to forest Hills Anderson and then we came into Kentucky and looked at four Thomas schools. So this person has a great point in terms of trying to get in a great school district, but also trying to keep your tax burned down.

“I have managed payroll for a manufacturing company with operations in 20 states. And I can honestly say that Ohio state and local income tax scheme is one of the most complex in the country. It does guarantee full employment for CPAs.”

So that’s hilarious! When this question comes up, I’m always kinda like it’s about the same, but there are so many different factors in it. It’s complicated. This guy says, basically call a CPA. And I should’ve mentioned it at the front, I’ll add it now. Disclaimer, I am not a CPA. I actually went to college for accounting, but I am not a CPA. But I do have a degree in accounting that I’ve never used. And my dad was super thrilled about that- not really. But talk to your payroll person, talk to an accountant to know what best fits your family, and know if it’s better to live in OH or KY.

Sarah again – “Great posting with a lot of helpful information. My husband and I were mostly retired (with some pension and incidental employment income.) When we tried, I admit half-heartedly to compare the overall tax burdens of our specific situation between Kentucky and Ohio, where we really bogged down with trying to guess it at the state level.”

So Sarah is like, it is hard to figure out, right? And it is, um, it’s hard to figure out. And this person, J Lawrence comes back and says “the best way to accomplish this would be to find a good CPA who specializes in taxes and buy an hour or two.”

Great point. Pay a CPA a hundred dollars an hour or two hours and say ” Hey! we are trying to save money” And let’s say, he gives you a tip of like “Yeah I live in Anderson Township and it saves you $300 a year for the next 5-20 years. It’s going to be really worth it to call that CPA and figure that out.

He said ” I have to admit that on my recent move to Arizona, through that I knew exactly what I needed to minimize my state tax liability. However, after preparing my taxes for the last past two years, I can say that there are several things that I’ve learned”

Lyndunn says “I can only speak on Cincinnati and Louisville. And I thought that the property taxes for pretty much similar, the only big difference is that I had to file a local city tax for Fairfield, Ohio. But my car insurance went up about 30% when I lived in Louisville. And it also costs much more to renew your tags.”

So this is also true in something a lot of people notice is that when you go to register your vehicle and Kentucky, even though you might be saving on some city taxes or different things, registration of vehicle might be a little bit higher there and you’re kind of paying some state tax through your registration. So that’s another kind of instance to factor in here in deciding if is it better to live in OH or KY.

There’s one other comment here. “I was going to say that having a car in Kentucky is much more expensive than Ohio. As far as taxes are concerned. Some municipalities around Cincinnati give credits for the occupational tax Chevy is one of them. That’s on the west side. I would look into whether any cities in Northern Kentucky give credit for the Cincinnati tax. If not, you’re going to be paying double tax. My spouse works in Batesville, Indiana, and we live in Cincinnati, no credit given by Cincinnati.”

So you can see, you can get into the nitty-gritty and you can save a little bit all the time. The big picture is it’s the cost of living in the greater Cincinnati area compared nationally is lower. So going to this chart right here (I just typed in Union, Kentucky versus Mason versus Cincinnati versus Ohio) In general, the cost of living is about 11% cheaper than the national average. So you are, if you really need to figure out the cheapest place, then you can drill down into these different communities.

You can see Mason, that’s showing us a little bit cheaper than Union or Covington or Cincinnati, which are all about the same. In general, it’s pretty close around that 10% to 12% lower than the national average. You can save a little bit of money if you pick the right spot. Talk to a CPA, talk to your payroll person. But overall you’re going to be saving some money.

As a realtor would then suggest, really, it’s less about how much you’re saving in taxes. We’re paying in taxes and probably a little bit more about where’s the best fit for you. Where’s the best fit for your family? What are the amenities you are wanting? Is that school district, is that a close commute? Is it being close to the amenities in downtown and the entertainment district and the arts and the restaurants, or is it having some acreage out in Alexandria or independence, Kentucky or New Richmond, Ohio, or Loveland or Milford or Lebanon or something like that- Do you want more land? Is it better to live in OH or KY?

Team Sztanyo Your Guide in Finding Your Way Home

Generally when this conversation comes up overall, as a realtor, I’m more going to point you to, what is the best place for your family and what really matters for your family. We believe at Team Sztanyo that home is where families grow strong together. And so think through how long are you going to live in this home and how can the home make your family stronger? Maybe that is saving a little bit on city taxes and that’s fine. Let’s figure that out for you and every dollar counts. But maybe it’s like the one person who’s trying to live in Kentucky and commute 50 minutes to Mason.

I’m going to say “you know what, let’s look at some homes in Westchester or maybe around Mason that are maybe a little cheaper, maybe Morrow or Lebanon where you can still get a great house and not have to commute 50 minutes to work every day. Right? So let’s talk about those things that are maybe the most important for you and decide if is it better to live in OH or KY.

I hope this sheds a little bit of light on it. Again, it’s kind of a complicated issue, but as I said at the beginning, overall, you’re saving money generally when you’re moving to the Cincinnati or Northern Kentucky area, and hopefully, this sheds a little bit of light on state taxes on the property taxes on the city taxes, on your withholding and all of that. I recommend talking to your payroll person, talk to a CPA and if you need help finding the area, finding a house, give us a call at team Sztanyo, we would love to help you out. Thanks so much, guys. And we’ll catch you the next time!