How a bridge loan can help you buy a house? That’s what we’re going to talk about in this video. Hey guys. Welcome back. It’s Eric Sztanyo from Keller Williams Realty and TeamSztanyo.com, where we are helping families find their way home. So I’m a Cincinnati and Northern Kentucky Realtor, and we are trying to bring all kinds of great content to you, the viewer, whether you’re buying, whether you’re selling, whether you’re investing, maybe in the Cincinnati, Northern Kentucky area, maybe anywhere. But if the content is helpful for you, please like the video, subscribe down below, let’s get into how a bridge loan can help you buy a house!

What To Expect When Selling And Buying A House In 2021?

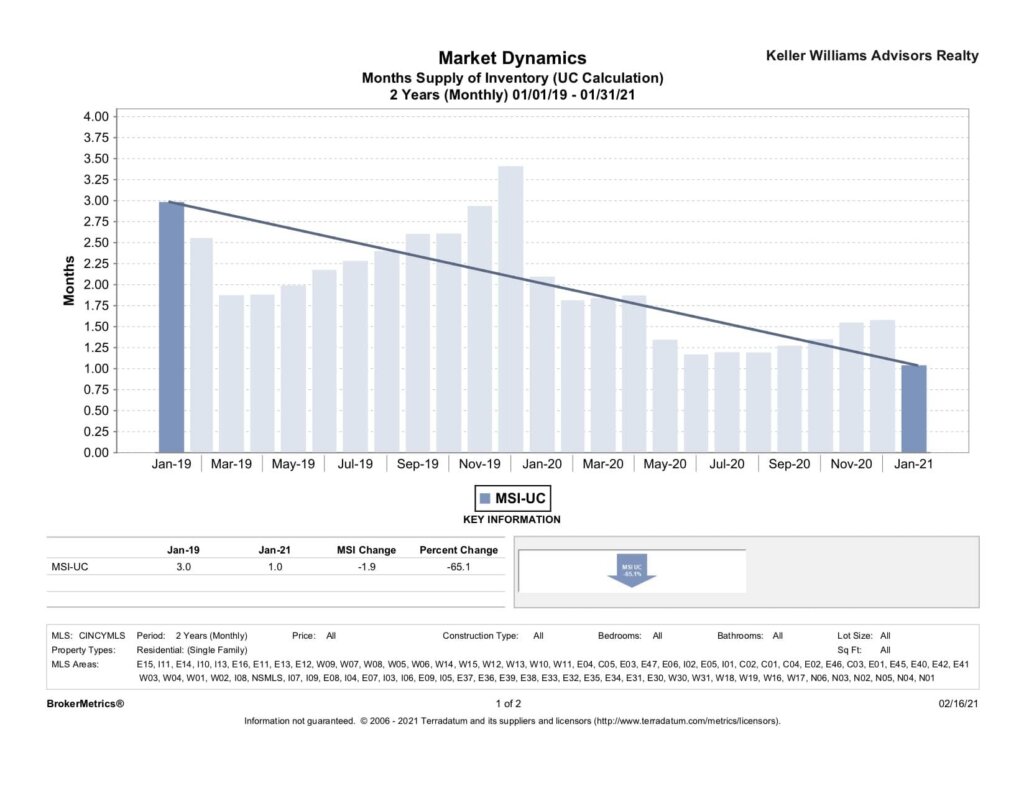

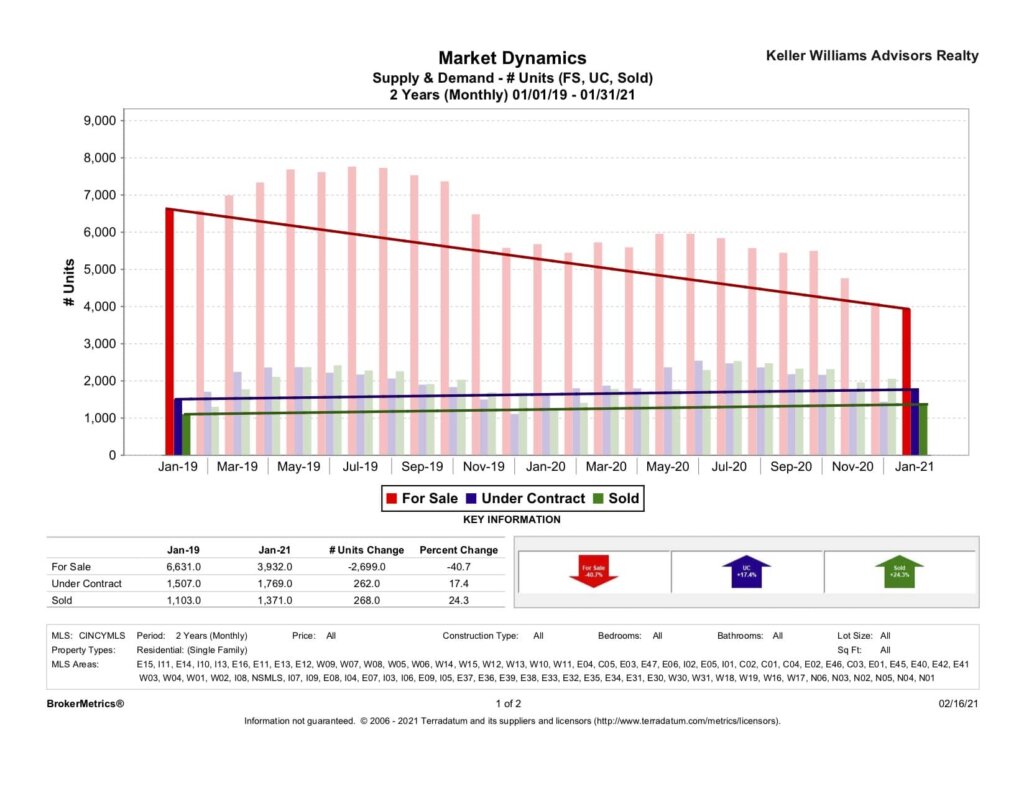

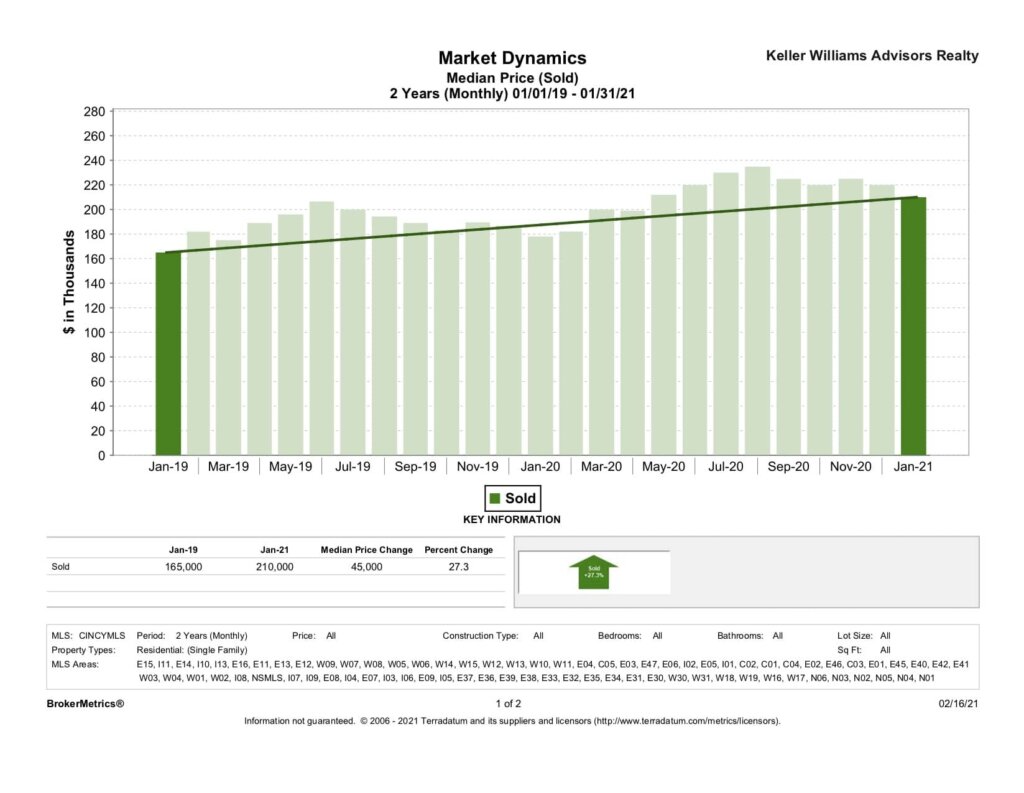

I was just watching the annual Keller Williams Family Reunion keynote speech with a bunch of other agents in my office. And Gary Keller was there going through different slides about unemployment and the real estate market. What we could expect in 2021. And one of the slides that stood out to me, which we’ve been looking at for a little while, and it’s continued to go down is the amount of inventory that’s out there. Not only in the Cincinnati market, but all across the United States. And the trend line, I’ll try to grab that slide and put it in this video. But if not, what it’s showing is there is a historic low amount of inventory of housing supply that’s out there for purchase. What does that mean? Well, if you’ve been out there trying to buy a house in the last few years, you know that it means basically, an all-out brawl to try to get a house. It’s crazy out there.

Houses that are priced right and that are in desirable neighborhoods or markets and are in any kind of good condition, very often are seeing multiple offers. They’re seeing over asking price offers and they might be sold on the first day. It might be sold in a couple of hours. Now, if you’re an agent worth your salt, you’d probably wait and try to get those multiple offers. But certainly, within the first few days, anything that’s priced in the right territory is going super fast.

So this means that it’s been incredibly hard as a buyer and maybe you’ve even had to overpay or what you think might be overpaying to get into a house that you want because the supply has been so low. So what does that have to do with this video? Well, we’re talking about how a bridge loan can help you buy a house, and if you’re a homeowner right now, and you’ve been thinking about selling, whether in 2019, 2020, now we’re into 2021, but you thought, why would I sell? Where am I going to go? That’s the big question is what am I going to do when I sell?

How To Sell Your House And Not Be Homeless

I see that the inventory is super low. I see that it’s a seller’s market. I know that I can cash in on my house and the equity that’s on my house, but what am I going to do? I’m going to be forced into buying something, maybe in a rush. And I might be buying something that I don’t want just because I sold my house. It doesn’t make any sense. So what can you do about that? There are a few different options you can do. The first option would be to go ahead and put your house on the market and get it sold and what you could do potentially, and work with your real estate agent.

You can do an extended closing date. So you might do 45 or 60 days, or maybe even longer than that, 75 or 90 days, which would allow you to go out shopping for the next house. So you have time to close and go shopping for the next house. And you’re not on the street or having to rent somewhere, go move in with family or whatever in the middle ground, while you’ve sold your house. You don’t want to sell your house and become homeless. You want to sell your house and be able to go into the next property. Now that’s great, but you’re still limited to a timeframe. And so the problem with that is if you don’t find a home that you want in that timeframe, or you’re out there fighting against all the other buyers, you’re stuck, you’re in a jam and you might be selling your house without being able to get into the next house that you want to get into. And that’s a big problem.

Another thing you could do with that is you could potentially write a clause since your house might be desirable, and multiple buyers are trying to get in, you have to find a flexible buyer for this, but you could write in a contingency that says, hey, the only way I’m selling this house is if I successfully enter into a purchase contract of the next house that I want to buy. Again, work with your realtor in terms of the language on how you’d write that contingency. But that’s a way to protect yourself to kind of say, look, I want to sell you this house, we’re agreeing on the terms, but it’s only going to close if I can go buy the next one. So those are a couple of ways to do it. Now you have to find the right buyer who’s willing to do those terms. So that’s kind of the downside to those options.

Another option that we want to talk about, and it’s kind of the heart of this video is what if you use a bridge loan to help you pull the equity out of your current home and go shopping, and go ahead and shop because you have the funds ahead of time, go ahead and shop for the next house before you sell your current house. So let’s get into the details of that.

What Are The Pros and Cons Of A Bridge Loan?

How a bridge loan can help you buy a house and what are the big advantages of bridge loans? Well, bridge loans simply help you avoid making a contingent offer on the home you want to buy. So if you haven’t sold your home yet, and you’re out there shopping, even if you have it under contract, when you go to purchase that next house, you’re going to need to check a box that says this offer is contingent on me being able to sell my current house.

Now you might be under contract or you might not be, but what that does is it kind of puts you at a disadvantage, if you think about it again, and you’re up against multiple buyers out there and you’re competing for the best houses, your offer is going to be a little bit dinged. It’s not as advantageous in the seller’s eyes because you have to sell your house first, before you can buy mine. And yes, maybe there’s a good chance that will happen, but there’s also the possibility that something will blow up in the real estate transaction. Maybe they find something on the inspection, maybe your buyer’s financing doesn’t come through. And now I have to wait on you or we have to release the contract because you weren’t able to sell your home.

So what the bridge loan allows you to do is help you avoid making that contingent offer because essentially what you’re doing is you’re borrowing against the equity that’s in your house. Let’s say you have a $100,000 inequity and a bridge loan might give you say, it might be an 80% loan to value ratio. So of that $100,000 in equity, you might have in your house, you can take 80 grand of that and go to purchase the next house. And you can make an offer that’s not contingent on you selling your current house. So that is the plus side, that’s the big advantage of a bridge loan is that in this market where the inventory is at historic lows and houses are moving super-fast, this allows you to go shopping. A bridge loan allows you to go shopping for a house without having to sell your house first. And without having to put a contingent offer on the property you want to buy.

Another potential pro of how a bridge loan can help you buy a house is you may be able to do payments that are interest only, or even defer them until you sell your first house. That’s a possibility. So talk to your lender about that. You may be able to get that done. Those are the advantages of having the bridge loan, and that certainly may make sense in this market as to why you want to use that.

Let’s definitely talk about the negatives or the cons of the bridge loan, because those do exist as well. First of all, you might be paying higher interest rates in order to get the bridge loan. In fact, your lender may even use a variable prime rate that increases over time. So again, make sure you’re using a lender you trust, maybe that your realtor can refer to you or other people that have used lenders that you trust, and make sure you understand the terms of the bridge loan before you go into it.

The next thing is you might have to go ahead and pay for the appraisal of your current house that you haven’t sold yet in order to get that bridge loan. And you might have to pay some closing costs and fees on the front end again before selling your house. So that could be a detriment. That’s a con where you’re going to have some costs upfront in order to get that loan secured before you go shopping and before you sell your current home.

And here’s the other big one that people get really scared about is there might be a time period where you purchase that second house and you haven’t sold your first house yet. So you might have two mortgages at the same time. That can be a scary feeling. And that keeps a lot of people away from getting the bridge loan. But when you’re in a market like we are now where houses are moving so fast and the inventory is so low and you might feel really confident about being able to sell your house quickly. And this is where again, I would say, talk to your realtor, look at the comps in your neighborhood, look at the average days on market. Because you might have two, three, five, ten comps around your neighborhood and the average days on market is like seven days or less.

Why A Bridge Loan Is A Good Idea To Help You Buy A House

You can feel really confident that you’re going to be able to sell your house. And yeah, maybe you have a month or two of two mortgages, but you’re not in that situation where you’re rushed and panicked and have to go buy a house because your house is under contract to sell and you’ve got to move out. So the bridge loan, it might be worth it to pay that one month or two months of two mortgages to have the peace of mind and less stress to be able to go shopping and buy that next house because you know you’ve built up the equity in the house you’re in currently. So it might not be a solution for everyone, but you can see where this tool in a market like we’re in right now, where the inventory is so low, houses are moving so fast and it is a seller’s market. So if you’re saying, hey, this house has been great for us. We’ve built up some equity and we’ve outgrown it. Or it’s not your ideal house for whatever reason. And there’s something, there’s another reason why you want to buy a separate house.

Maybe you’re upgrading to more bedrooms because you’ve had more kids, or you want to get a more open floor plan, you want to move to the country, you want to move to the city, or you want a view of water. Whatever it is, why you might want to get that second house and cash out on the equity you have right now. The interest rates are also historically low. So maybe you want to lock in whatever, a nicer, bigger home with a lower interest rate while those are also very historically low right now. The bridge loan might make a lot of sense for you to go ahead and shop for that next house. Get that one under contract that’s not contingent. And then you can feel free to put your current home on the market and not feel like you’re in that rushed panic state.

Reach Out To Us To Learn More Of How A Bridge Loan Can Help You Buy A House

I hope that makes sense as a little bit of an overview as to why you might want to use a bridge loan. Again, if you felt this video was helpful for you, please like it down below, please subscribe to the channel, and give us any comments or thoughts. Have you used a bridge loan and other ideas for content you guys want to see on this channel? We’re continuing to build it out around all things real estate in the Cincinnati and Northern Kentucky area. Guys, thank you so much for watching and we’ll see you next time.