Searching for Real Estate update? The October, 2022 market data for Cincinnati just came out. Whether you’re looking to buy or sell in the area, it’s always good to know what is going on in the market. We are here to give you the latest and greatest info. Let’s get into it. My name is Eric Sztanyo from Keller Williams Realty and TeamSztanyo.com where we are helping you find your home and strengthen your family. I hope you’re having a wonderful day or night or morning or whatever time it is. We’ve done several of these market reports trying to understand what’s going on in the market. There’s a lot of stuff going on. The last few years have been crazy. Interest rates are up now, obviously, you guys know that. Inventory continues to stay down, but what does that mean? What’s actually happening in the Real Estate Update? That’s what we wanna look at today. Who’s got the data?

Understanding The Real Estate Update As Of October 2022

For our Real Estate update, here’s the latest press release from the Realtor Alliance of Greater Cincinnati for October, 2022. And the headline says that “The market is still in favor of sellers.” We’ve been saying that over and over again that the market is slowing down, but it’s still a seller’s market. Buyers are getting a little bit more buying power than they used to have, but inventory’s still low. Still a seller’s market. Let’s see what it has to say. This was released on November 10th. It says, Hamilton Butler and Warren County. So we’re just looking on the Ohio side. “Home sales dropped 30.8% in October from September.” That’s a big number. When I first read that, I’m like, well, October to September is one thing cuz there’s seasonality. We’re gonna look at year over year here later.

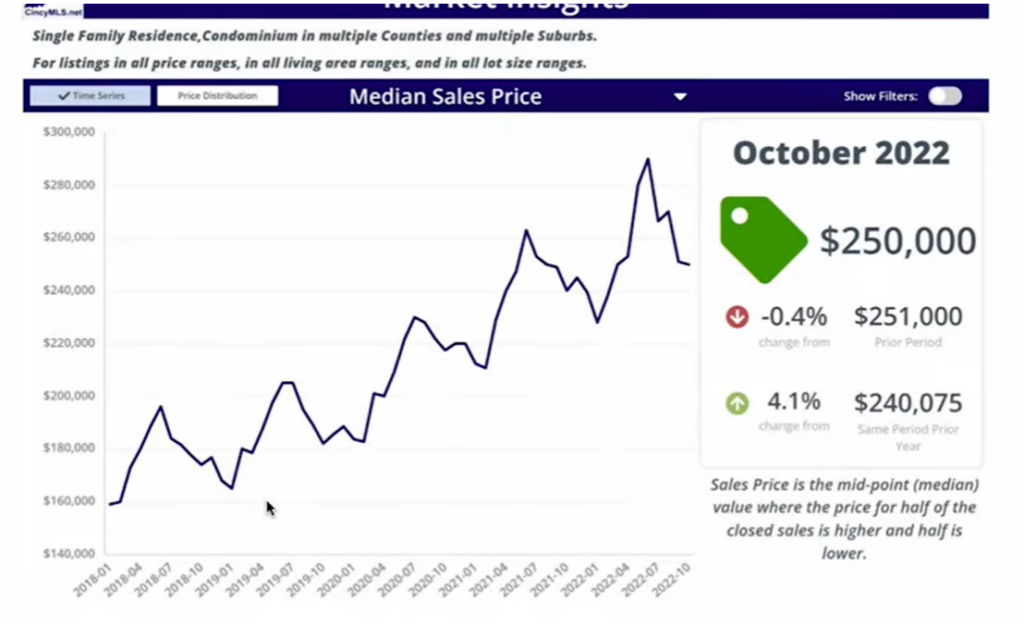

“The active inventory is up 19% from September.” That’s also a big number. This is interesting, maybe some of the biggest shifts we’ve seen this year. “The median sales price in October 22 increased by 4.1% from September to $250,000.” So month over month it went up 4%, the median sales price and it went up 7.9% higher than October, 2021. So that’s another thing. If you talk to me on the phone or if you’ve listened to these videos, you know I’m saying, Hey look, housing prices are still going up. They’re just not going up as fast as we’ve seen the last two years. This would kind of give that indication again. Year over year it’s up 8% from October to 22 to 21. Here’s what Kay Edwards has to say, she’s the president of the Realtor Alliance of Greater Cincinnati. “While the number of homes sold is trending lower, the average prices continue to grow over the previous month.” “If you’re wanting to buy, this is still a good time in spite of supplies being low.”

Some of you guys might be watching this and be like, you know what? I was shopping a few months ago and rates were down around 3%or 4%. So I don’t know if I fully agree with you, Kay, that it’s still a good time to buy in spite of supplies being low. Well, I get where you’re coming from. Interest rates going up, certainly have an impact on both buyers and sellers because if you’re a buyer you’re like, man, I could have bought X amount dollars more house than I could have bought just a few months ago. If you’re a seller, you’re like, do I really wanna sell now then go have to buy at 7% when I’ve got this locked in at 3%.

I get it. It’s a big deal. That’s why things are like whoa, slowing down. The impact of the rates are having, the effect that the powers that be I think wanted to have, which was kind of pump the brakes on the economy. So everyone’s kind of pumping the brakes. One of my real estate mentors who actually went and worked for these guys for about a year before I became an agent, Russell Gray, if you guys ever listen to real estate podcasts for real estate updates, these are like the OG real estate podcasters, the real estate guys radio. But he used to always say, do the math and the math will tell you what to do. So whether you’re looking to buy right now or looking to sell right now and you’re considering interest rates, you gotta do the math. Like on the buy side. What you need to consider a little bit here is yes, rates are up, however, home prices are still going up and rates could continue to go up.

And so there’s a lot of people being like, “well I don’t want to do it now because it was 3% a few months ago.” Yeah, well they might be 9% in a few more months or 10 or 11. I mean that’s not unheard of. We’ve shown this chart on the channel before, you go back to the late ’70s, and early 80’s, and it hit what like 16%, 17%, 18% interest rates. So there’s that to consider. There’s also the chance that you could buy now if rates do go down, you can refinance, right? So you’re not locked into that rate forever. You can always refinance. But if home prices are still going up, which we’re gonna look at here and you need a house, maybe that’s even more important. If you need a house, you might want to buy one instead of sitting on the sidelines.

Let’s look at this chart a little bit here for the real estate update. Here’s basically that same press release in graph form. So the median sole price, $250,000. Year to date, it’s up 7.9% over, I guess that’s 241 from last year. Prior year to date. So year to date, 260 units sold. We’re gonna look at that 1343 down 30% in October. This number is the total sold volume. And again, I think this is looking at October versus September was down 27%. So around 413 million prior year was that might be year over year, 5.29 million last October. Days on market is creeping up to 5 median days on market. That’s up 67%. That’s very interesting. If you’re a buyer and active inventory is up 19%.

Here’s one more chart that I think is interesting. You know, going back to 2018, there are these personalities and that’s why I’m gonna look at these charts in a minute that are year over year. So you can kind of see what you typically see for home prices here in the Cincinnati area is they hit their peaks around July, August, probably that’s a peak sales price because all that demand from the spring and summer has like reached its peak. And so it’s maybe it’s lowest in January and February. It’s climbing, climbing, climbing, climbing, climbing peak and then it dips down a little bit at the end of the summer, September, October, November and goes down to its lowest point, January, December, then back up again. So you see this going back to 2018, you’ve got peaks in falls, but what you also see is home prices have continued to go up year over year. That’s why the median price continues to go up. So yes, you could wait and not buy, but you also need to again do the math and the math will tell you what to do.

Consider that that same price that you might wait on this year because interest rates are now 6%, 7% might cost you at $250K it’s probably gonna cost 10% more. Next year it’s gonna be $275K. Do the math. Yes, maybe you’re paying 500 bucks more a month. That’s 6 grand on the year, but it’s, the house costs 25 grand more next year. So it’s gonna take you 4 years. Does that make sense? It’s gonna take you 4 years before that increased payment covers the increased price of the house.

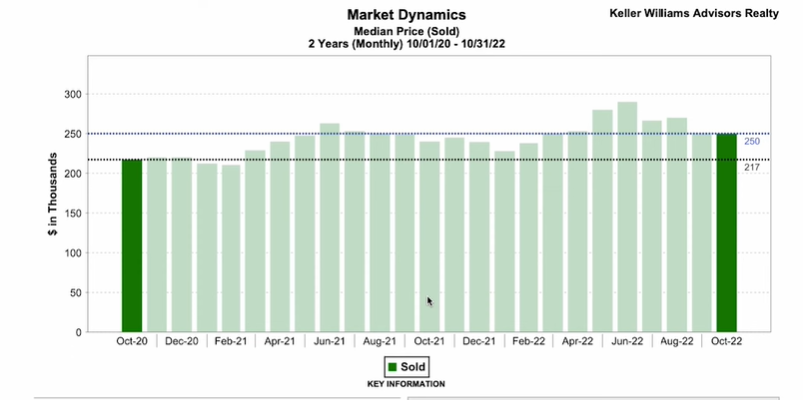

So month over month data is one thing. Year over year is another. You guys have maybe seen these charts before, but these are looking at all residential single-family and condos sold in Butler, Warren in Hamilton counties in Ohio over the last 2 years. What we’re seeing here is the same thing. You see the median sale price at 250 in October of 2022. That started at 217. So just going back to my point. 2 years ago in October, the median sales price was 217,000 and basically, it went up roughly 10% over the last 2 years. So it went to in October of 2021. Looks like it’s right around 2 35 -240 in that range. And then it’s gone up a little bit slower this year to 250, but it hit its peak in May and June of 2022. That’s when everything was just crazy. And now since the rates have gone up, it’s brought things back down a little bit.

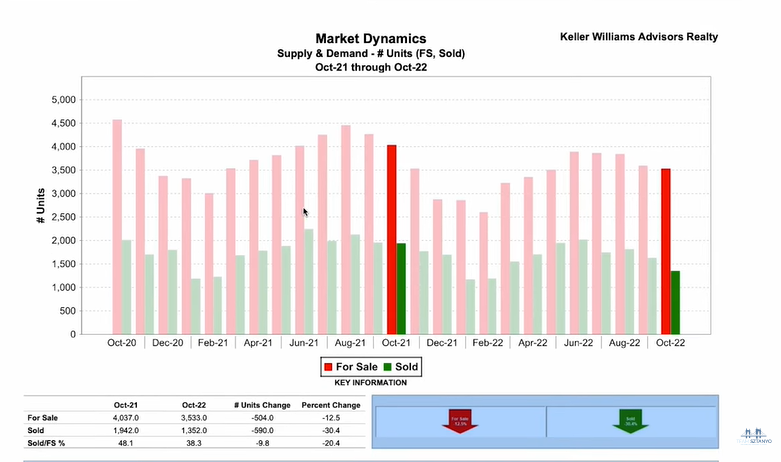

So moving on here, looking at the supply and demand of units that have sold over the last few years. In fact, I just wanted to look year over year here cuz the realtor alliance said it went down 30%. I’m like, is that just September to October or is that year over year? So prices have gone up year over year and what we’ve seen is the amount of sales from October. So if you look in this green column, that’s the amount of sold properties in October, 2021. That number is 1,942 houses in 2021. That number dropped all the way to 1352 in 2022. So that actually did go down 30%, not just month over month, but year over year. That’s a big drop. So the interest rates going up is like whoa, everyone has kind of slammed the brakes a little bit. That’s a significant drop for it to go down 30%. Now the amount of units for sale, went down 12%. So there were 4,000 for sale in October of last year. There were 3,500 in this year. So the inventory continued to be low, and stayed down.

And again, if you’re a seller, do the math and the math will tell you what to do and you’re thinking, well I want to cash out on the appreciation that I earn the last few years cuz the market went so haywire. Well a lot of people are saying no to that cuz they’re like, well the interest rates are so high, well do the math. I mean, you could cash out and make whatever equity you’ve gained in your house, 20, 30, 40, 50, 60, 80, I don’t know how many, how many thousands of dollars. How long will the next payment on the house you want to be in, whether that’s upsizing or downsizing because of the interest rates where they are right now, take you to catch up to the cash out amount. Does that make sense? And it might not be apples to apples, but you get the idea just because rates are fluctuating. Again, take this with a grain of salt torch me and I get it. Like I’m a real estate agent. I make money on you buying and selling, but you also do actually do need to do the math and figure out what’s best for you and know the real estate updates.

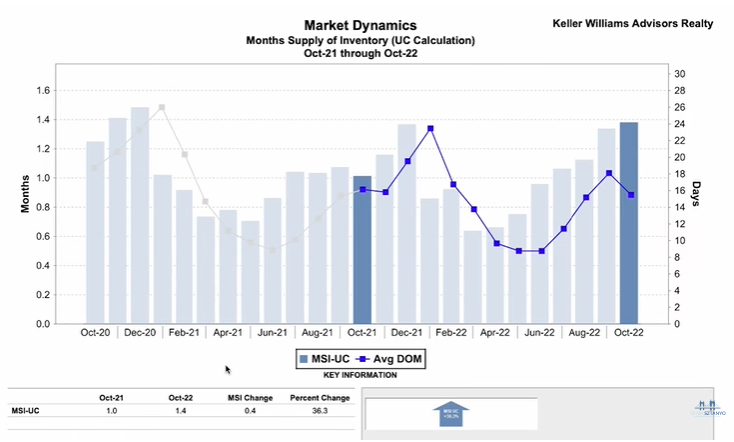

Okay, last chart I I wanna look at here is the month’s supply of inventory. October of 2021 on the Real Estate update, there was one month of supply that has gone up slightly to 1.4. That is a large percentage change. It’s a 36% change in the amount of inventory. So there are more houses on the market. This is playing itself out. And what I see when I’m out there with buyers, which is yes, there are still a few houses that are gonna get a lot of activity when they first hit the market. If the realtor’s smart, they’re pricing it a little bit below what the comps sold for in June, July Cuz that’s what the market’s saying right now. You get that activity, you might have 2, 3, 4, 5 offers for those properties that are in good condition and priced Right.

Back in May, June, July, you would have 10, 15, 20 offers for those same properties. So that has slowed down significantly. And what you’re also seeing is there are a lot more properties that aren’t selling in that first weekend or that first week or those, maybe even those first two weeks. And that’s why this days on market is creeping up, why it’s gone up 36% compared to year over year to October of 2021. So if you’re at a buyer, that’s great. That gives you a few more options. It’s not so pressure-packed. You don’t have to make offers. You know, as many offers over the ask price. You don’t have to wave your inspection or do an appraisal gap or do all these crazy things or sell your firstborn baby or whatever it is, to win the house. You can kind of shop a little bit more.

Now it’s, again, going back to that statement by K, it’s still a seller’s market because the inventory one month of inventory or 1.4 months that is still far below average. I mean, normally that is like six months of inventory is a normal market. So that’s why we’re saying it’s still a seller’s market and that’s why prices are still going up. Because you still have more demand than you do supply. Things are leveling out. Buyers are getting a little bit more buying power, but it is still a seller’s market.

Team Sztanyo! Your Trusted Guide to Real Estate Investment

All right! hopefully, you don’t have a headache from this. Too much math, too much data, too much charts. As a realtor, I’m trying to always definitely educate both my buyers and my sellers on what’s going on in the market so you can make wise decisions for you and for your family. If you have questions about what’s going on and you’re like, I don’t know, I’m thinking about renting, I’m thinking about buying, I’m thinking about selling, hey, leave it in the comments below. We’d love to answer those for you. Or give us a call at Team Sztanyo. We’d love to help you guys. (513) 81 6293. If this was helpful to you in any way, give us a like, subscribe to the channel, and be a part of the Sztanyo clan. Thank you guys, we’ll see you next!