Are you thinking of buying or selling a home in 2022? We’re gonna dive deep into the data and look at some 2022 housing market predictions. My name is Eric Sztanyo from Keller Williams Realty and team Sztanyo.com, where we are helping you find your home and strengthen your family. I mentioned previously that I wanted to do a kind of a predictions video on 2022, where the housing market is going earlier in the year, so that if you’re looking at either buying or selling a house in these upcoming months, you could have some data and make an informed decision. So let’s dive right into the housing forecast for 2022. We’re gonna be working off an article from realtor.com, looking at some of the data from 2021 and what the experts saying on the housing market predictions for the upcoming year.

Here’s an overview. This article titled 2022 housing market predictions and forecast. A whirlwind year. Americans will have a better chance to find a home in 2022. But we’ll face a competitive seller’s market as first time buyer demand out matches the inventory recovery. Additionally, with listing prices, rents and mortgage rates, all expected to climb while incomes rise, 2022 will present a mixed bag of housing, affordability challenges, and opportunities. This is kind of an overview summary right here, but it’s saying that first time home buyers, it’s gonna be tough. Incomes are expected to rise a little bit in 2022, but also our listing prices, rents and mortgage rates.

Whether the pandemic delayed plans or created new opportunities to make a move. Americans are poised for a whirlwind year of home buying in 2022. With more sellers expected to enter the market as buy buyer competition remains fierce. We anticipate strong home sales growth. Affordability will increasingly be a challenge as interest rates rise and prices rise. But remote work may expand search areas and enable younger buyers to find their first home sooner than they might have otherwise. Below you’ll find our forecast and housing market predictions.

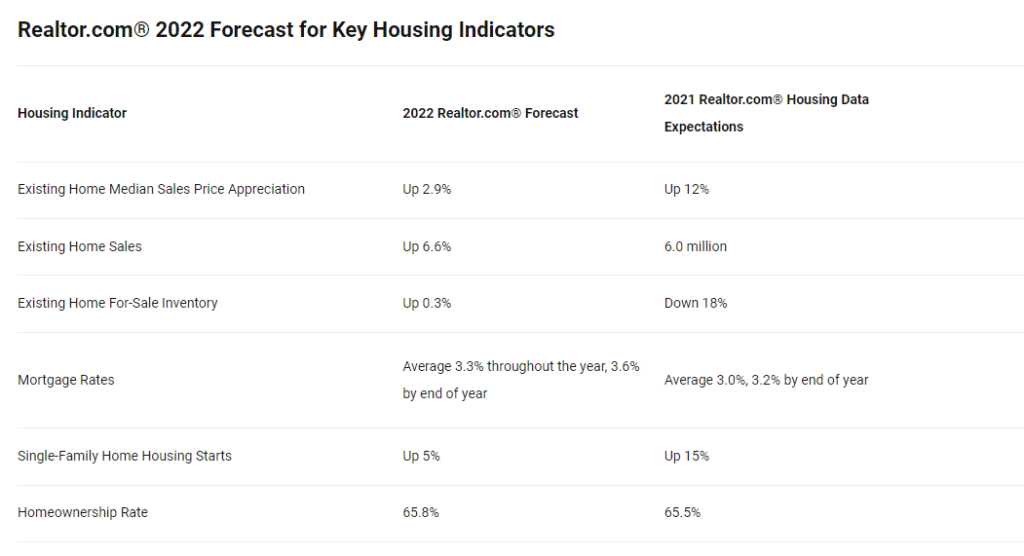

We’re gonna dive into all of this, but the main thoughts are there’s gonna be slightly more housing hitting the market. As some sellers are a little bit more comfortable selling, but also it’s gonna be an affordability challenge for buyers. So let’s keep diving into the numbers here. So here are some 2022 for forecast for key housing indicators. It’s taking data from 2021 and it’s comparing it to their forecast from mueller.com for 2022.

Existing home median sales price appreciation was up about 12% in 2021. They’re expecting that to forecast to be up about 2.9% in 2022. So it’s still go up, but it’s gonna be not as high of price appreciation as we saw in 2021.

Existing home sales 6M in 2021. They’re expecting that to go up 6.6% in 2022.

Existing home for sale inventory was down 18% in 2021 for a number of factors. People were having a hard time if they sold, they didn’t know what they were gonna do was a big reason. The pandemic certainly was another reason. They’re expecting that to be up just slightly at 0.3%. So it’s gonna curb the low inventory from last year. And it’s gonna be about up just slightly this year.

Mortgage rates, they average 3% to 3.2% by the end of year in 2021. Well, the feds planning on increasing rates in 2022. So they’re expecting that to mean mortgage rates are gonna increase from 3.3% up, probably 3.6% by the end of the year. To be honest, I wouldn’t be surprised if that was higher. Single family home housing starts were up 15% in 2021. They’re predicting up 5% in 2022. I find that a little bit curious to me if builders are seeing all this demand, they would only wanna ramp up more housing starts, but that’s what their prediction here is.

Home ownership rate is gonna be slightly up from 65.5% to 65.8%.

What To Expect In A 2022 Whirlwind Year

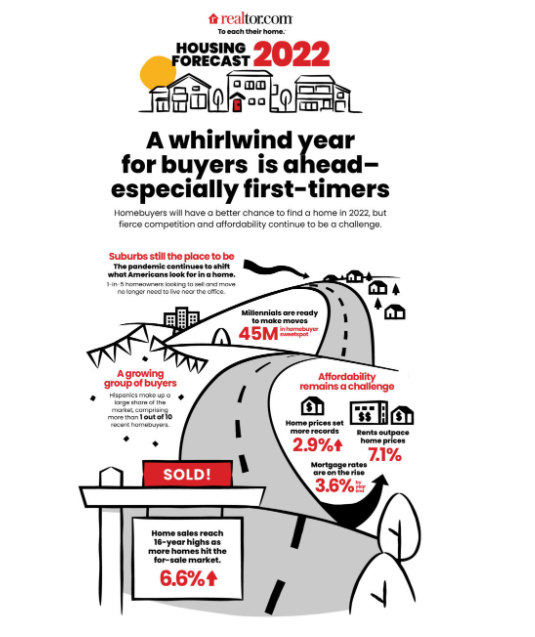

so we keep going down here and they did this little infographic with some other larger statistics and some big ideas. 2022, they’re expecting in a whirlwind year. I don’t really know what that means for buyer, We’ll keep diving into it, but especially for first time buyers, they’re saying it’s gonna be a challenge again, basically that home buyers will have a better chance to find a home. So they’re predicting a little bit more inventory on the market in 2022, but they’re still gonna be fierce. Competition and houses are still gonna be really expensive. So that makes it a challenge. This I can see completely being true.

The housing market predictions is saying that suburbs are still the place to be. And here’s why. The pandemic continues to shift what Americans look for in a home. 1-in-5 homeowners looking to sell and move no longer need to live near the office. With being able to work from home or telework. A lot of people who have those jobs, you don’t need to live close to the office. You don’t need live right in the city. If housing prices is going up, you wanna buy that bigger house out in the suburbs. If you have kids, you might want to have a dedicated home office as it’s just opposed to a bedroom somewhere or that may be the fourth bedroom upstairs or fifth bedroom. That may be a finished basement. That may be an office on the first level, but people want that home office continues to be really important.

Another big key component to the year is that millennials continue to be ready to make moves and buy homes. There’s 45 million millennials now in that home buyer sweet spot. We’ll look at that a little bit more.

Hispanics are growing. They’re a growing group of buyers. They’re actually one out of 10 recent home buyers. So that’s a demographic to continue to monitor and watch.

The affordability remains a challenge. So it says home prices set more records. They were up 2.9%. Rents outpace home prices sent by 7.1%.

A lot of people I talked to this last year who sold and a lot of the idea behind selling was, “I’m gonna sell this year. I’m gonna take the profit on the equity that’s increased the appreciation, and then I’m just gonna wait the market out.” I had this conversation over and over again with people where they said, “oh, my housing market predictions is that it’s gonna crash. So I’m just gonna wait it out. I’m gonna rent for a while. And then I’ll come back and buy a house when the market crashes.” probably not gonna happen. And this is what I told people this last year as well, going into 2021 was “look, I know you have in your head 2008, 2009, 2010, when we had the great recession and the market did crash and I get it, I actually, unfortunately bought my first house in 2007 , right before it crashed. But you’re thinking like, well, it’s gonna crash. It’s gonna go on sale.

The problem is the underlying statistics and the underlying supply and demand was way different then. We’re gonna keep getting into this more, but essentially you had way more supply and then you had very low demand when the recession hit. And what’s happening right now is it’s completely flipped. You’ve got low supply because builders coming out of the recession had a low inventory for 10 years, where they were afraid to over build. And you have all this demand that’s only increased since the pandemic. More and more people wanted to buy houses. So when you’ve got strong demand and low supply prices are gonna go up, that’s just where we’re at. And that’s hurting you on the rent side. Rent outpaces home prices by 7.1%. So it’s not like it’s helping you to rent right now, either. And mortgage rates are gonna be on the rise. We mentioned because of the fed rates. They’re gonna be 3.6% by the end of the year is what they’re saying. And sold home sales reached 16 year highs as more homes hit the market for sales 6.6% up.

I try to understand what this all means, what that might mean for you. If you’re looking to buy a home this year, or if you’re thinking about selling a home this year or both potentially.

Home sales hit 16 year highs

At a national level this means we expect to see continued home sales growth in 2022 of 6.6%, which will mean 16 year highs for sales nationwide, and in many Metro areas. With more than 45 million millennials in the prime first time home buying ages of 26 to 35 in 2022 demand for housing is expected to remain strong. A growing economy and declining unemployment as discussed in our economic outlook. Also propels income growth by 3.3%, by the end of the year, keeping sales levels high, despite climbing mortgage interest rates.

So you’re gonna make a little bit more money, but housing prices are gonna continue to go up. But because there’s so much demand from buyers who wanna buy houses, housing prices are gonna go up as well.

In most Metro markets, our model suggests that home sales will follow the national trend and increase in 2022’s. You’re gonna have more home sales in 2022. While some markets are expected to see home sales declines. These declines are likely to be modest. In fact, for many areas forecasted to see declines 2022 is expected to have the second highest sales level in the last 15 years, bested only by 2021. So 2021 banner year. 2022 is still gonna be a high level of sales, just not quite as high as 2021 in terms of the highest sales level.

Home Sale Prices

Home sale prices on the housing market predictions. They’re expected to still go up a little bit more moderately than 2021, but they’re still gonna be continuing to set records. Home sale prices are set to continue to increase, which will mean notch in a decade long streak of year over year increases early in 2022. Early -note that. The rise in home prices, which began in 2012 has proceeded consistently, If unevenly. Following the pickup from post recession lows, home prices logged more than a year of double digit in 2013. But since that time, the pace of increase has been a more modest 4% to 7%. This changed in 2020. The pandemic ignited a frenzy in the housing market. A decades long shortage, which meant the market was already 5.2 million single family homes short – when the pandemic hit – (So what I mentioned before the builders had not been building. We were 5 million units short in 2020.) Was met with an unprecedented surge and demand. Just as many were expecting the opposite response to the pandemic uncertainty.

I remember in the first month of the pandemic. Gary Keller got on and he’s the head of Keller Williams and he was making videos and he was like, “get ready for the shift to agents. You got to double down on your lead management and all your lead generation” and all this stuff. They’re like, “it’s gonna get competitive out there. And there’s gonna be less people buying”. And the opposite happened and no one was really expecting it because what all these people, all these millennials, essentially, a big chunk of it who were living in apartments were like, “yeah, I don’t want to live near other people right now. There’s a pandemic. I know nothing about. It’s an airborne illness. I wanna have my own space. I wanna buy my own house.” Which led to all this demand that happened. While builders worked to adjust the market balance high demand and short supply by pushing prices higher. That’s what we saw all last year. Prices just went up .

August 2020, kicked off a year long streak of double digit home price growth. Looking ahead with economic growth expected to sustain the purchasing power of eager home buyers. We expect the median home sales price to continue to increase rising 2.9% in 2022, a notably more moderate pace. So it’s gonna, the chain’s gonna slow down a little bit. It’s still gonna grow, but not as fast. As builders ramp up production into meet demand. Home buyers will grapple with higher monthly costs due to rising prices and rising mortgage rates. Affordability challenges will keep prices from advancing at the same pace we saw in 2021, even as ongoing supply demand, dynamics means prices continue to grow nationwide. Bottom line, home prices are still gonna go up. Not quite as fast as 2021. Builders are trying to catch up in terms of demand.

For-sale inventories says it’s gonna slightly begin to turn around in 2022

So with home selling and continuing to do so quickly, inventory will remain limited. If you went out buying in 2021 or 2020, or you knew friends who did, you know that when a house hit the market or you saw your neighbor’s houses hit the market. And in one, two days, boom, they were gone. If you’re priced, right and if you’re in a good condition with your house, they’re gonna go immediately, probably in multiple offers. So in 2022, inventory’s gonna remain limited, but our housing market predictions is it will rebound from 2021 lows. We’re talking about inventory right now, 2021 was historic lows in terms of housing inventory. They’re expecting that to rebound a little bit. Inventory is expected to grow 0.3% on average in 2022. So not a lot, there’s still more demand than there is the inventory.

While buyers have been eager in the last two years, sellers have been on and off a rising share of homeowners this fall reported planning to sell a home in the next 12 months. So I think what’s happening is sellers, they weren’t sure what was happening in 2021, 2020. But now they kind of understand a feel and have a better feel for the market and housing market predictions. And so more people are planning to sell this year. So this could signal an improvement in this trend that has been a major challenge for the housing market with 28% of homeowners choosing not to sell indicating that the reason for doing so is because they can’t find a new home to buy. Yes, that happened a ton this last year. A pickup in inventory could be self-reinforcing drawing out other potential sellers as they find homes to buy. What happened a lot in 2021, 2020 was realtors were like, “Sell your home. You know, you’ve got all this equity, the depreciation has happened.” And the, and the sellers were like, “yeah, but then what? Like, I’m gonna sell my house and make a lot of money, but then I’ve got to go buy something and it’s a wash cuz when I go buy it super expensive too.”

So my advice to a lot of home sellers this last year was like sell it If it makes sense. If you need to downgrade, if you need to upgrade, if you have the opportunity to buy something off market and fix, if you have a reason to sell then sell, if not, maybe hold put.

Rising new construction will eventually feed into this positive trend as well. So the builders are trying to catch up. But first, builders pipelines catch up to the usual balance of already completed versus under construction versus not yet started homes. When I’m talking to cons new construction home builders in Cincinnati; Fisher homes, Drees, MI homes, Miranda. They’ve got so much demand as well.

And so they’re just trying to keep up like as soon as they put out new houses, as soon as they open up new lots, those are getting sold quickly as well. And to be honest, they’re like, we don’t need your help cuz we’re selling all of our properties really quickly and they’re trying to catch up to just delivering those homes that’ve already sold before, where they can get actually more supply on the market and make this larger supply catch up. Completed new homes have recently made up half their usual share of all new homes for sale while homes not yet started are twice as prevalent as usual. In other words, new homes are in many recent cases, only a viable option if you can wait for the construction process to finish. So a couple years ago, construction process time for these larger production home builders, not a custom home builder was probably something like four to six months is what they’re telling me.

Now they’re telling realtors and they’re telling buyers that process is probably gonna be nine to 12 months. Part of that is supply chain issues. Part of that is just they’re trying to catch up. So that’s a look at the for sale inventory for 2022, it’s gonna try to catch up, but it’s, it’s got a big way to go. So it’s gonna be about even this year.

The key 2022 housing trends and demographics

Buyers are still preferring the suburbs

Again, that goes back to a lot of people working from home, wanting to get a little bit more space.

Working remote in office or hybrid? The future of work brings flexibility for workers

And it says here: while a majority of recent home buyers who didn’t have firm return to work plans report that they would simply return to the office or try to arrange a hybrid schedule in the event they were called back nearly 1-in-4 report that they’d find a new job if asked to return.

People wanna work at home. And so a lot of those people, they want these bigger home. They’re trying to enjoy with less time in the office, you wanna enjoy your house more. So a lot of people continue to wanna buy in the suburbs with bigger houses and budgets play a big part of that. So searchers dream big, but budget realities and for sale availability might mean smaller homes prevail. So with the suburbs still popular and at least occasional remote work likely and option, home buyers are likely to continue to prefer larger homes that provide space for working at home from time to time, as well as versatility at the same time, rising affordability challenges may cause some home buyers to decide to sacrifice space, to make a home purchase work with their budget. Notably new constructed single family homes have begun to get larger after declining over the last few years. However, the typical active single family home for sale has trended smaller in recent months.

So people want bigger homes. They want more affordable homes, but the reality of the affordability of it might not make that an option, especially for a lot of first time home buyers.

First time home buyers

In many respects, it’ll be an uphill journey given the slightly better, but still limited for sale inventory environment, high and rising prices and rising mortgage rates, all pushing monthly costs higher. A competitive labor market, however should help offset some of these higher costs in the form of higher paycheck. So you might make a little bit more money, but you got to buy more house. Additionally, extended workplace flexibility may enable first time buyers to explore more affordable housing markets that wouldn’t be an option if a daily commute was expected.

So maybe you’re saving some costs on parking downtown. You’re saving some time from driving downtown. You’ve got a little bit less auto expenses, potentially. The sheer size of the population at or near typical first time home buyer age will mean plenty of potential from this group to impact the market in 2022.

So that might mean housing ownership does go up just because there’s so many millennials looking to buy, but it’s a challenge for you as first time home buyers, sorry to say.

If you are a first time home buyer, how can you prepare in 2022?

Knowing your housing market predictions. To navigate these challenges, buyers will want to kill carefully, consider their budget before embarking on their home search. This is a great advice. Buyers can use online tools. You can use calculators to kind of get a feel for what your payment’s gonna mean. But the bottom line for buyers, no matter what the calculator says, make sure it feels comfortable to you. Additionally, honing a list of must-haves versus nice haves can help shoppers keep their search focused and buyers can also use personalization tools so that their online search is similarly dialed into their best fit.

So what does that mean? Know your budget. If you’re a first time home buyer don’t overspend, don’t put yourself in a bad situation for payment, even though I know you want a house, I know you want space. It’s a tough time in the market. If you really want a house, just be conservative. You might want to even consider what my wife and I did when we were young in our marriage, which is do a house hat. You could do that by buying a duplex or a Triplex and living in one of those units, renting out the other two. The other thing we’ve done in our marriage, you may or may not wanna do this, but we had roommates for a large chunk of our marriage, where we bought a house that had an extra bedroom and we rented part of that bedroom.

For us. As we had kids, it grew a lot of times that was a college age girl who could help with some of the household efforts who could pay a small amount of rent. So it was kind of a win-win where it was more affordable for them than it was for if they were to go rent an apartment on their own somewhere. And it worked out for us, cuz my wife had her friend in the house. We had some childcare in the house potentially. And also we got a little bit of rent. So it was helping paying down our mortgage slightly. It’s just an idea. It sounds a little crazy, but Hey we did. And it helped us out definitely throughout the years.

What will 2022 be like for home sellers?

Home owners who are ready to sell in 22 are in a good position. Home prices are likely to notch a decade long streak of annual gains early in the year. And the value of homes is at a record 34.9 trillion. According to the fed data as of mid 2021. And likely to continue higher with next week’s release of new data. Even as for sale inventory begins to grow. Meaning some sellers will face competition, well priced homes and good condition will continue to sell quickly in many markets and for sellers who have owned their homes for a while, this will likely mean that they walk away from the transaction with a healthy amount of cash. While surveys show that many sellers recognize the advantage they hold in the current housing market predictions. Other data show that it’s challenge of buying that’s holding some back more than one in four homeowners choosing not to sell report. (This is in our a recent survey) The sellers, most points to take advantage of this market are those who don’t also need to buy immediately, those ready to sell second or vacation homes. But with some offices opening back up, even as other companies shift to indefinite, remote work policies, homeowners and vacation markets may find a notably cooler housing market predictions than prevailed in these areas in 2021 when vacation homes surged and surfaced unexpected vacation towns.

So I said that a little bit earlier in the video, but what does that mean for you? A seller in 2022, it’s still a great time to sell. I mean, your appreciation’s still gonna be high. You’re gonna have a ton of buyers out there, but you got to figure out what are you gonna do after you sell? So if it’s a good fit for you, whether it’s a second home, a vacation home, you’re looking to downsize, maybe you’re looking to upsize. Maybe you’re looking at a house to rehab. Maybe you can rent for a while. If you’ve got a good landing spot, then it’s gonna be another great year for you to sell in 2022.

Help In Buying Or Selling Your Home In 2022

So there is the overview and the predictions and the forecast for 2022. Whether you’re looking to buy or sell, I strongly recommend you reach out to a professional, a realtor who can help you think through all these different items. Think through what’s gonna be best for your situation.

We’d love to talk to you here at team Sztanyo, as always. We think that home is where families grow strong together. We would love to help you find that home here in the Cincinnati, Northern Kentucky area, or potentially help you with your home sale here in 2022, as it’s gonna be another strong market for sellers . You can reach out to me personally at Eric.Sztanyo@kw.com. I would love to hear from you guys!

So we looked at the 2022 predictions as a whole for the inventory. In this next video that you guys can watch. We’re gonna look at the housing market predictions per Metro area breakdown. And when you guys look at this video and what’s happening in different parts of America, you’re gonna be really intrigued and going to watch that video. Please. Like this video feels helpful for you and subscribe to the channel or bring you tons of great real estate content here in the Cincinnati and Northern Kentucky area. Thank you guys so much!