The housing market is crazy rents and housing prices are going up at an incredibly fast rate. Is this a bubble, like in 2007? Will the housing market crash in 2022? Should you sit it out and wait until prices come down? I’m gonna show you why real estate prices are not going to be slowing down anytime soon. We’re gonna look at inventory. We’re gonna look at housing prices. We’re gonna look at mortgage rates and we’re gonna analyze all this data together. And I’m gonna tell you exactly what you should be doing about it. My name is Eric Sztanyo from Keller Williams Realty and team Sztanyo.com, where we are helping you find your home and strengthen your family. I’m a licensed realtor here in Ohio and Kentucky in the Cincinnati and Northern Kentucky area. Let’s find out, will the housing market crash in 2022?

The $75,000 mistake

I wanna start this with a sad story, about a friend of mine named Bob, and I call this story the $75,000 mistake. See, here’s the thing. And this is happening a lot to me as a realtor, but Bob came to me two years ago and he said “You know what, Eric, my credit’s in good tax. I’ve got some savings. I think I’m ready to stop renting and buy a house.” And I’m like “Bob, that’s awesome. Let’s get you that American dream and let’s buy a house.” But as he got into it, he noticed “Hey man, there’s not a lot of inventory. There are a lot of buyers out here. It’s pretty tough competition. Housing prices seem to be going up. You know what? I think I’m gonna pull back and not buy a house right now.”

So Bob decided to wait until the market cooled off. And he said you know what? I’m just gonna keep renting. And here’s the sad, sad story. Two years later, Bob’s rent is up 30%. And not only is his rent higher, but the prices of all the homes he was going to buy two years ago are all now higher. He missed out on two years of appreciation. If Bob would’ve bought a $300,000 house back in 2020 with about the normal real estate appreciation we’ve seen here in the Cincinnati market of 25%, he would’ve earned $75,000 in equity in just two years. And sadly, this is why Bob had to learn the hard lesson of the $75,000 mistake.

Maybe you hear that story and say “Yes, that was Bob two years ago.” Or maybe that was you two years ago. And you’re saying “but it’s not gonna happen again. This is a bubble. This is crazy. I’ve gotta sit this out. I don’t want to buy a house right now.” Let’s calm down. Let’s take the emotions out of it. And let’s look at the data. Shall we?

The Crazy Low Housing Inventory

To further answer your question of will the housing market crash in 202? I wanna show you guys through housing inventory, through housing prices and through mortgage rates. Why, what we’re experiencing right now is not like 2007, 2008, 2009. I talk to people all the time. We who’ve lived through that and they’re like, yes, it was a bubble. It crashed that’s what’s gonna happen right now. Right? Probably not. I’m gonna, I’m gonna show you exactly why that is. Let’s first move over to this chart about why housing inventory right now is just so crazy, crazy low, and what happened.

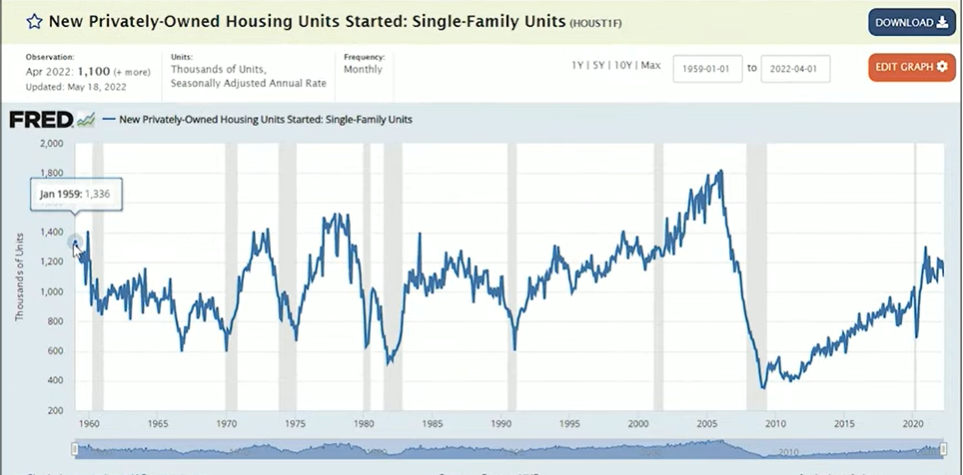

Okay. Bob time to meet FRED. We’re gonna look at the federal reserve economic data. This is from St. Louis fed, but this has national data on the amount of housing units that were built every year, going back to about 1959 or so. And you can see it moves along at kind of a steady clip and really from about 1995 or so all the way up to 2006, the housing families that were started by builders went up and up and up and up and up. And then the crash hit in 2007. And there’s a giant fall, all the way down. So, at the peak, you were seeing about 1,804, that’s thousands of units started in around February of 2006, and then it crashes all the way down from 2007 and 2008, all the way down to the bottom of 2009, that number goes from 1600- 1800 all the way down to around 350 in March 2009.

Again, will the housing market crash in 2022? If you look at this chart and you’re looking at the averages of where it should be for basically the next 10, 12 years or so, up until 2020, you see about 10, 12 years where builders did not keep up with the average amount of housing starts needed to just maintain the housing inventory in the United States. And it makes sense, right? When you had a housing bubble, if you go back to 2007, what happened was anyone could get a house. Builders were building tons of houses. So they ramped way up. And then the great recession hit everyone foreclosed. You had massive amounts of inventory on the market. Builders didn’t need to build because there was no demand from buyers. And then they just got scared. They got scared. What if that happens again?

So for the next decade, they didn’t build as many houses as were needed. And now we find ourselves here, 15 years later. And not only do you have a very low supply of housing because builders didn’t build, but now you have all of this demand because millennials who were living in their parents’ basement for the last decade are now all coming out of that basement or the rental. And they’re saying, I want to buy a house right now. So you’ve got this huge piece of the population with all this demand wanting to buy houses and the houses just aren’t there because the builders didn’t keep up with the demand. So you can see on this chart, they’ve been ramping that up, but it takes time. It takes time to develop new land and put in utilities and put in new roads and build new subdivisions.

And then you had COVID that kind of slowed all that down in terms of the supply chain process. So, yes, right now builders are trying to catch up, but it’s gonna take some time for all the demand that is there and all of the lack of supply that is there over the decade-long where they didn’t build enough. So it’s crazy how long it’s gonna take to get out of this.

Will the housing market crash in 2022? I want to show you guys a few clips from a recent 60 minutes video. That’s talking about this supply shortage, but also another factor of the demand. That’s not just the millennials, but in terms of the investors and the institutional money, that’s coming into the market, making this even more of a difficult time to buy a house. So here’s a clip that shows why builders didn’t build enough over the last decade and how big is that shortage?

Reporter:

What is causing this?

Interviewee:

We are not building enough housing for everyone who needs a place to live. We built fewer homes in the 2010s than in any decade, going back to the 1960s. And at the same time, the millennials are the biggest generation and they are entering a home-buying age. Millennials aren’t living in their parents’ basements anymore or shacking up with roommates. They want a place of their own, and we didn’t build any housing for them in the last decade, because we were still so traumatized by the last housing crisis.

Reporter:

In the economic crisis of 2008 and 2009, the construction of new housing came to a grinding halt. But even when the economy recovered, home construction didn’t. So how big is the rental shortage in the United States?

Interviewee:

The government has estimated that we are short about 4 million homes in this country. And that number is likely to grow, especially since the pandemic.

The Biggest Competitors in Buying Houses

So you have this huge shortage from builders, but now you also have this new institutional buyer from Wall street coming in and also competing against you who are trying to buy a home. They’re competing against you in the marketplace. Will the housing market crash in 2022? Check out this clip:

With something as essential as housing in such short supply, you have to figure that Wall street would see an opportunity in buying modest single-family houses, the kind you see on any middle-class suburban street, and then renting them out.

Interviewee:

In places like Jacksonville, Atlanta, and Charlotte, investors are buying almost 30% of the homes that are available for regular buyers.

So you can see in some of these marketplaces that these institutional dollars are coming in, and they’re buying up nearly 30% of all the available houses. So you’re competing against cash offers from these institutional buyers, check out this one, this company named Tricon, and what they’re doing:

Now 60 minutes introduces the bad guy capitalist who everyone just wants to hate. His name is Gary Berman. He is CEO of TRICON residential. A Toronto-based company that has quietly become one of the largest owners of single-family homes in the United States.

Gary:

So today we own about 30,000 single-family rental homes across the United States, largely in the Sunbelt. And we have about 75,000 people living in our homes.

Reporter:

You are a multi-billion dollar company and you are traded on the New York stock exchange and the Toronto stock exchange. I even read in one of your documents that your revenue went up last year by 67%?

Gary:

Yeah, we’re expanding. And when you think about it, we have an incredible amount of demand for what we do. In any given week. We have about 200 houses available for renting, and we get about 10,000 leasing inquiries per week. TRICON is trying to buy 800 houses per month. And there are companies that are even bigger.

This is such a huge problem. And I feel for so many of you who might be first-time home buyers, cause you are the ones who are really getting pitched. The product that these institutional buyers are buying, and I’m not saying they’re bad. I believe I’m a capitalist. I believe in it, but this is just something you’re dealing with. And if you’re thinking the bubble is gonna burst, you don’t have to look any further than looking at these investors. Where is their money going? If their money’s going into buying inventory and buying houses, then it’s a good bet that they know what they’re doing.

These guys are the ones who are trying to make a lot of money. The problem is you’re having to compete against these people on the market for the limited amount of inventory.

The houses Tricon and other investors are buying in places like Jacksonville are what might be called starter homes, usually selling for about $300,000. And when one of those comes on the market, investors are ready with all-cash offers.

Interviewee (Heather, Redfin real estate agent in Jacksonville) :

I would probably say one-third of the listings that I am putting up are getting all-cash offers. You’re seeing a lot of these Wall Street investors coming in. You put a house on the market and within an hour, I’m getting offers of full-price cash and the sellers are seeing that. You put a house on the market and within an hour, I’m getting offers of full-price cash.

And the sellers are seeing that and saying “Oh, I can get full price cash and close in 15 days? It’s very enticing to people when they see that offer come in.

So this is where it gets really tough for you. You’re having to put in an offer over the asking price, and you’re having to compete against these investors who are coming in with cash offers. Sellers always want cash. If you’re a seller, the financing you want, number one is always cash because there’s no appraisal to worry about. And you know, it’s gonna close. After that is gonna be conventional and then probably VA or a USDA loan, and then maybe FHA at the bottom. That’s kind of how you rank financing as a seller. So as a buyer competing against to these other cash buyers, it’s really difficult.

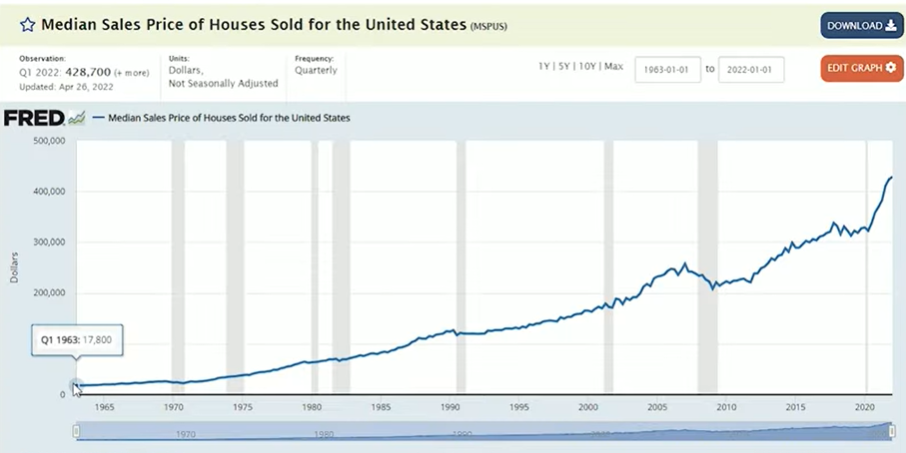

Will the housing market crash in 2022? So maybe you’re not convinced yet. Maybe you still think it’s a bubble. I wanna show you a little bit more data. Let’s go over this chart about the median sales price of housing sold in the United States. Again, going back to around the early 1960s, you can see just kind of a gradual steady line all through the seventies, eighties, nineties, and then, you know, the biggest dip you see in terms of housing prices not going up is that great recession. We experienced starting in 2007, it hit a peak in Q1 of median sales price around $257,400. And really it took all the way until about it took till about Q1 of 2013 until you got that equity back. So if you were able to stay put during the recession and just kind of wait it out, it did come back in about four or five years there. And from 2012 to about 2020, again, you see that steady growth where the medium sales price goes up to about $322, 600 in Q2 of 2020.

What happened in Q2 of 2020? COVID hit. And what happened to the median and home prices as a realtor? I remember everyone in my brokerage. I remember Gary Keller creating a video, saying “Get ready. Realtors here comes the shift. It’s gonna be like 2007 all again. And all the prices are gonna go down. So get ready to market to your customers.” And what’s happened since then. The exact opposite home prices have gone through the roof in the last two years. So from Q2 of 2020, you see a median sales price of $322, 600. And right now, as of Q1 of 2022, that’s jumped all the way up to $428,700. What’s causing that? Low supply, high demand, basic economics. So if you combine this data and you go back to the previous chart and you think through, well, where is inventory and where is demand? And the truth is inventory has not yet caught up and on the demand side, you’re also competing with these institutional investors.

So where are housing price is gonna go? they’re gonna go up again. It’s simple economics of when there’s low supply and high demand for a product, the price is going to go up. But Eric, you say “Interest rates are going up. Surely that’s gonna keep people from wanting to buy houses as the interest rates go up, housing prices are gonna go down.” I’m really sorry to tell you. That’s not the truth. Let’s look at the data one more time.

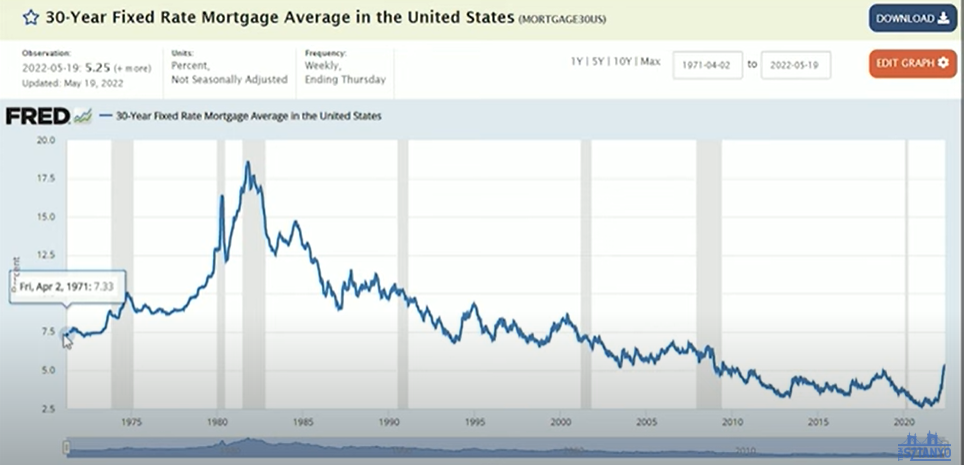

All right, Bob, all of you, Bob’s out there and asking if will the housing market crash in 2022. Let’s look at FRED one more time. We’re gonna look at the 30-year fixed-rate mortgage average in the United States and what we see going back in again into the 60s. And this is really the 70syou see, we’ve got it pretty good. Overall, if you look at this chart because yes, we’re seeing interest rate hikes. Yes, they very well could continue to go up. But if you were living in October of 1981, which is when I was born, the average interest rate in October 1981 was 18.6, 3%. We’re not living in those times, at least not yet. Praise the Lord. And from then, so you had major inflation in the seventies and into the early eighties there. And the interest rates steadily went down, down, down, down, down, basically all the way until just recently. Until late 20, 21, early 20, 22 here. But if you go back and look at that median sales price of houses sold, even when the interest rates were crazy high in the 70s and the 80s into the early 90s, the housing prices chart just went up steadily. It only really went down in the recession in 07, 08, and 09. So even when you have high interest rates, it doesn’t slow down housing prices going up. That’s very important fact for you guys to realize here.

Yes, interest rates going up is going to decrease demand a little bit. But when it comes to housing prices, supply is way more important than demand. And we’re simply short on supply right now. And it’s not gonna come anytime soon.

Why Do You need To Buy Your Own Home Now?

So let’s wrap all this up and try to understand it so you guys can have some action steps here. So is the housing market going to crash in 2022? Probably not the data that’s showing that that’s probably not going to be the case. And if you’re looking to sit it out, if you’re hoping that interest rates are gonna bring down the housing prices, if you think I’m just gonna rent a little bit longer? You’re probably going to make that same costly financial mistake as Bob.

I know prices are high. I understand gas prices are crazy. I understand inflation doesn’t seem like it’s stopping anytime soon. And, I understand that real wages are actually down right now. But I also know that this probably isn’t slowing down anytime soon. And if you think I’m just gonna keep renting? You’re probably just gonna keep seeing rental price hikes. And without having a house of your own, you can’t benefit from all of the crazy appreciation that’s happening right now.

So yes, I’m a realtor and take this for what it’s worth. But I think if you continue to wait on the sidelines, you’re gonna continue to be left further and further behind. I wanna go back to the 60 minutes video. One more time and close on this. And again, I’m not trying to make you sad. I’m trying to give you the data so you can make wise decisions for you and your family.

You’ll see in this clip that the investors are saying “Hey, millennials love to rent these houses. That’s what they want to do. They wanna rent. They don’t really want the American dream of owning their own home.” And the millennials in the clip are saying “No, we just can’t attain our dream. Yeah, we want a house. It’s just unaffordable.” And so what you’re seeing right now, if you continue to sit out on the sideline is wealth is gonna continue to go to these investors and not homeowners.

Even TRICON’s own presentation to investors says “homeownership is increasingly out of reach”

Gary:

In our portfolio, the majority cannot buy a home, cannot afford to buy a home, or they don’t have the credit to buy the home. For example, they may have student or medical debt and therefore they can’t get a mortgage. And if they want access to a single family home, which we think is incredibly important, this is the best way for them to obtain it.

I think if you asked a lot of millennials and that tends to be our primary resident, they would probably tell you they don’t necessarily desire to own a home or to own a car. They’ve grown up in the sharing economy and what’s important to them is lifestyle. And so if they can move into this turnkey home that gives them the lifestyle they want, that’s very compelling to them.

And now we switch over to an interview of a few millennials who are actually trying to buy a house.

Journalist:

We were told by the head of one of these big companies that people, your age want to rent, that you’re not as interested in buying a house?

Millennials:

No, I think the American dream is owning your own dirt and owning your own house. That’s specifically why we moved to this place was to own a house.” And then his wife says “I realized that our first house is probably going to be a starter home. It’s not gonna be that dream house, but it’s a house. It’s a home. And now our dream is unattainable. It’s disturbing. Most people desire that single-family home with that picket fence. And if they can’t buy it because they can’t afford it, their only option is to rent it.

Journalist:

Yeah. But the investor is buying it.

Millennials:

Yeah. And they’re getting the wealth that normally, in previous years would go to the person living there.

Help In Buying Your Own Home with Team Sztanyo!

I’m gonna show you one more clip from this video that kind of, to me encapsulates the feeling of what’s going on right now. But I wanna say if you’re ready to get off the sidelines, if you’re interested in buying a home specifically in the Cincinnati or Northern Kentucky area, give us a call at team Sztanyo (513) 813-6293. If that’s another city where you’re watching this from, I can get you guys a referral within the Keller Williams world. We can refer to the highest, most productive agents in that city. So if you wanna a referral, contact us as well.

I’m gonna leave you guys with this final clip.

Journalist:

So what’s happened to the American dream. When we used to say that we met owning a house, what’s the American dream?

Bad Guy Gary:

Well, if we think the American dream is embodied in a suburban home with a white picket fence, then you can rent the American dream.

That is if you can afford the rent…