For many people, a home is the largest investment they will make in their lifetime. With the right financial tools, most people can find an affordable home they love and want to live in. Sometimes things don’t work out. In the current seller’s market, if you can’t buy a home in Fort Thomas KY, it’s because you don’t have your ducks in a row. If you get prepared and have the right agent, you can buy a home in Fort Thomas and get into those wonderful schools!

Here are five reasons people can’t buy a home in Fort Thomas.

5 Reasons People Can’t Buy a Home in Fort Thomas

Not Getting Pre-Approved

If you are serious about buying a Fort Thomas home, get serious about your loan. Don’t get pre-qualified, which is merely a ballpark, unofficial value a lender gives you. Get pre-approved; this means the lender has checked your credit, looked at income resources and tax returns. They know your financial picture and give you the amount you can afford based on reality, not fantasy.

Without pre-approval, you might have an offer accepted on a home but not be able to fund the loan because the lender simply didn’t have all the information ahead of time. In today’s market, you can’t afford not to be pre-approved. When that perfect home in Fort Thomas comes on the market, you need to be ready to move quickly. Having the pre-approval lets you present an offer that sellers will give higher regard.

Don’t Have Closing Funds

Many people only think about the down payment when considering out-of-pocket expenses in the home purchase process. There are closing costs and you need to have the money to pay them. Everything from lender fees to appraisals and inspections are due at closing. Some costs are rolled into the loan but others aren’t.

On average, expect to pay anywhere from two to five percent of the home value in closing costs. Talk to your lender at the onset of the loan process and make sure you have enough dough to close. If not, you might be scrambling to tap retirement funds, get gift funds or walk away from the deal.

Too Much Debt

Lenders look at your overall debt-to-income ratio when considering if you can buy a home. You might have solid monthly income, but if credit card or car payments eat away at it every month, you are not in a financially stable position that lenders are comfortable with. On average, monthly debt payments should not be more than 33 percent of your monthly income.

If you have a student loan that is in some sort of forbearance, keep in mind that the lender will use the payment you will incur when the forbearance expires.

Apply for New Furniture Credit Line

It happens all the time. You are pre-approved and the escrow process is humming away. You’re anticipating moving in and having the brand new living room set delivered to enjoy the first football game. The only problem is you decided to get the 6-months financing deal with the furniture company.

That is a credit inquiry and added debt that can affect your loan. People have loan funding denied, even after being pre-approved because of last minute credit inquiries. As a rule of thumb, wait until escrow closes before you get the furniture. It delays things a few days but ensures you don’t change the dynamic of your financial picture. That goes for any other purchases, like a car, that might affect your credit score.

Shopping for Your Dream Home

You can’t always get what you want. Yes, we’ve all heard the song. This is very true when buying a home. If you are waiting for your brand new dream home with the chef’s kitchen, spa bath and swimming pool, you might be waiting for a long time.

Smart buyers will buy what they can afford in a place they are comfortable living. As they make payments and property values increase, they get equity. This equity can be used as down payment when selling this first property to buy the bigger and better home in the future. Be the smart buyer and use equity to get to your dream home.

Many people moving to Fort Thomas, KY are moving to the city because of the top rated Fort Thomas Independent School system. If you want your kids in the best school district in KY, then you may be willing to shop for a house that doesn’t check all the boxes. We’re still going to help you find a home you love, but just remember, it might not check every single box on your dream list.

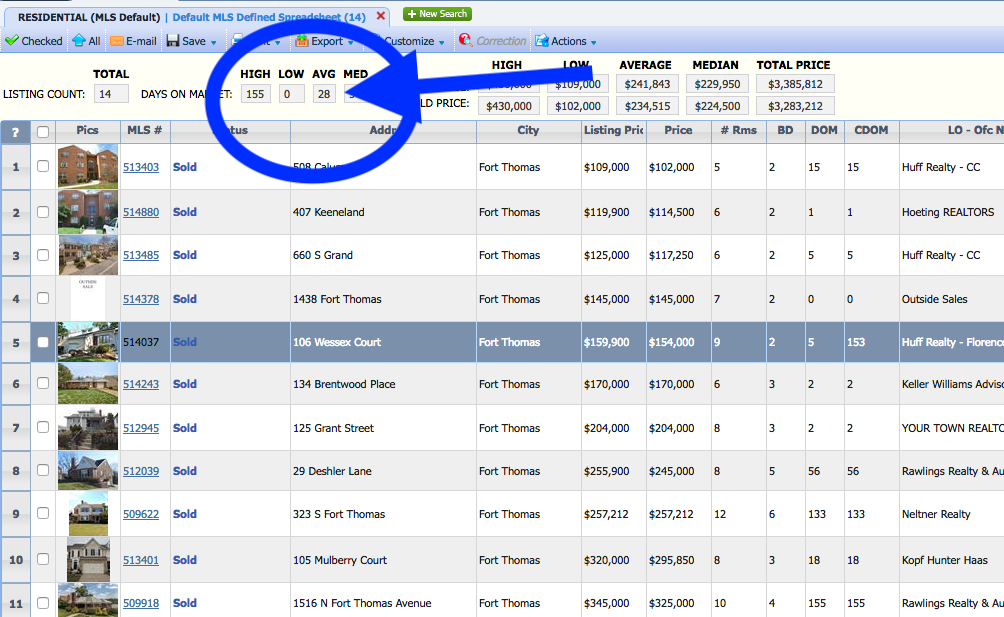

If you look at the image below, you’ll see that the Average Days on Market for homes sold in the last 30 days in Fort Thomas is 28 days. That means houses are going fast! If you don’t have your financing in order and are working with an agent who can respond rapidly to new inventory on the market, then you can’t buy a home in Fort Thomas, KY.

If you want to secure your chances of buying a house in Fort Thomas, give us a call today.

IF YOU NEED ASSISTANCE BUYING OR SELLING A HOME IN FORT THOMAS, KY, CONTACT US AT (513) 813-6293 OR FILL OUT OUR ONLINE FORM TODAY!

Local, Top Real Estate Agent Who LIVES In Fort Thomas, KY

If you are asking yourself, “who can help me buy or sell my dream house in Fort Thomas?”, then you should look no further than the agent who actually LIVES in Fort Thomas, KY.

If you are asking yourself, “who can help me buy or sell my dream house in Fort Thomas?”, then you should look no further than the agent who actually LIVES in Fort Thomas, KY.

I live in Fort Thomas, KY with my wife and four children, so I know everything I need to know about the Fort Thomas real estate market. My kids are at Moyer Elementary. We hear the Highlands marching band and football game from our front porch. We play at Tower Park, hike the Fort Thomas tree trail and then mom and dad need a pick me up at Fort Thomas Coffee!

If you want to work with a top real estate agent who is local and knows how to buy and sell houses in Fort Thomas, give me a call.