Do you live in a Recession proof city? With rising mortgage rates and talk of whether are we or are we not in a recession? You might be thinking, is it time for me to cash out with the equity I’ve earned in my house over the last few years? We’re gonna look at where the real estate market is at and where it’s heading. We’re gonna look at the downturn risk scores of various cities across the country. And we’re gonna ask the question; is Cincinnati, Ohio, one of the most resilient housing markets in the entire United States? My name is Eric Sztanyo from Keller Williams Realty and team Sztanyo.com, where we are helping you find your home and strengthen your family.

Is Your City Recession Proof?

Maybe you own a house somewhere across this great land of America. And the housing market has boomed over the last few years. It’s been red hot, it’s just gone up and up and up. The supply has been so low. The demand has been so strong that housing prices have continued to go up and your house, you’re sitting on a bunch of equity and you’re thinking, you know what? I feel like the wind might be turning here just a little bit.

We’ve got two consecutive quarters of negative GDP. Now, is that or is that not a recession? Seems like definitions are a little looser than they used to be, but either way you’re seeing mortgage interest rates rise, and you’re like, maybe I might want to cash out. And so you might be looking across the country and going, where would I want to go where I can take the equity out of this home and maybe buy somewhere else where it makes a lot of sense? That’s what we’re gonna get into.

So I wanna point you guys to this article that came out here in early August from the Cincinnati business courier, it’s titled “The Cincinnati housing market ranks among the most resilient in the United States.” This study says “Rising mortgage rates and talk of recession are generating concern about a housing downturn, but a new analysis shows Cincinnati is among the Metro area’s best position to weather, such a slump researchers with Seattle-based real estate brokerage firm, Redfin analyzed data for 98 cities to rank them on their chances of a housing market downturn. Cincinnati was built among the most resilient markets ranking. Number 6 on the list of those places with the lowest chance of downturn tying with Boston.”

Having lived in Cincinnati for 30-plus years in Northern Kentucky. This data doesn’t really surprise me all that much. Oftentimes when I’m talking to you guys who are looking to move here from the area and you wanna know about the real estate market, I describe it a little bit as it’s a river city. Which means we’re pretty even keel. We’re pretty steady. We’re kind of behind everything. We’re in the Midwest. And when markets get hot, hot, hot across the country, we don’t go like super high. And what I mean by that with a river city, it’s like, we’re not a mountain type city, right? And we’re also not an ocean. Like we’re a river we’re right in the middle.

And when markets get really hot, we don’t get as hot as the other markets. When there’s a downturn, like there was in 2008, we also don’t go down as far as everyone else. So in the last few years, we’ve seen historically low inventory in the Cincinnati market. And some of the most appreciation that the market has ever seen here, but at the same time, it’s not as high as some of these other cities that are now at risk of a serious downturn. If the downturn comes, if the recession continues, Cincinnati is probably not gonna dip anywhere as close as some of these other cities that are at much greater risk.

“Redfins analysis of housing markets in 98 U.S. metros uses several housing-related indicators, including home price, volatility, average debt to income ratio, and home price growth. Each city was assigned a risk factor relative to the other metros. Of the 10 cities with the most resilient housing markets, almost all were in former Rust Bell areas or on the East Coast, with three in Ohio. “

The list includes:

No. 1: Akron (29.6)

No. 2: Philadelphia (30.4)

No.3: Montgomery county, Pa (31.4)

No. 4: El Paso, Texas (32.2)

No.5: Cleveland (32.4)

No, 6: Cincinnati (32.6)

No. 6: Boston (32.6)

No. 8: Buffalo, N.Y. (33.1)

No. 9: Kansas City, Mo. (33.4)

No. 10: Rochester, N.Y. ( 34)

And you see these grades ranging from 29.6 to 34. Cincinnati is right here at 32.6.

These are the cities that have the lowest chance of a market downturn or a recession proof city if it continues strong here.

“Although fears of a recession are rising an economist with Redfin tamped down speculation of a crash like the U.S. saw in 2008.

He says, quote, if the U.S. does enter a recession, we’re unlikely to see a housing-market crash like in the Great Recession because the factors affecting the economy are different: Most homeowners have a fair amount of home equity and not much debt and unemployment is low. Says this Redfin senior economist Sheharya Bokhari said in a news release.”

So this is the story I’ve been talking to a lot of people lately. If you’ve been sitting on the sideline, you can the other article we did about the $75,000 loss. Like if you said “Well, the markets are hot, housing prices are going up, I’m gonna sit it out and rent these few years.” Well, you just missed out on a lot of equity and a big reason why people did that, It’s understandable is you were thinking about the 2008 great recession, and you thought, well, prices are gonna fall. The bubble’s gonna burst. But what this economist is saying, what most industry leaders that I talk to have been doing this for a lot longer than I have, when I try to glean their wisdom, they’re like, look, the factors are different.

When we were heading into 2007 and 2008, we had all this supply and anyone was getting houses. Even if their credit wasn’t very good, even if they didn’t have any equity in the home. And so we had a bunch of people who bought houses, who probably shouldn’t. All this supply and kind of low demand. Well, it’s the exact opposite. Now we have all this demand and very little housing supply because over the last decade or so, builders didn’t really keep up with the amount of population growth and demand of housing that we needed to have.

And now housing prices have gone up because of its high demand and low supply. There are also, people who have a lot of equity in their house right now. So even if we do hit a harder recession here, going forward to the end of 2022 and into 2023, people have more savings and more equity built up into their houses and unemployment is very, very low. So it’s unlikely that it’s gonna be anywhere as big as the 2008 recession.

Cities That are at Risk in The Recession

Now let’s look at the cities and the areas that are most risky. And then you might want to think, you know what? I think I want to cash in my chips right now.

“The cities most vulnerable to price decline year over year during a recession are those that have seen an influx of migration, particularly the places where people flock during the pandemic.”

So that’s interesting. It’s where there’s been a lot of people coming over the pandemic. These are the cities that have the most risk going forward. Here are the 10 cities most at risk of seeing a housing downturn. It’s not guaranteed that prices will go down, but these are the cities that are at the most risk of that happening.

No 1: Riverside, Calif. (84)

No 2: Boise, Idaho (76.9)

No 3: Cape Corral, Fla. (76.7)

No 4: North Port, Fla. (75)

No 5: Las Vegas (74.2)

No 6: Sacramento, Calif. (73.1)

No 7: Bakersfield, Calif. (72.2)

No 8: Phoenix (72)

No 9: Tampa (70.7)

No 10: Tucson, Ariz. (70.1)

So if you live in one of those cities and surrounding areas, and you’d like to kind of cash out on the equity, you’ve got, cuz you don’t want see that downturn coming. You might want to think about cashing in the chips right now.

Let’s jump over to the Redfin article and it’s titled “Pandemic Home Buying Hotspots with Steep Price Increases Most Susceptible to Housing Downturn in a Recession.”

So if prices went way up in the last few years, then you’re at the most risk. The article goes on to say:

“Popular migration destinations, where home prices soared during the pandemic, including Boise, Idaho, Phoenix, and Tampa are most likely to see the effects of a housing downturn amplified and home prices decline year over year. If the economy goes into a recession, a scenario that some economists believe looks likely as inflation persists and stock markets stumble. Homeowners in those areas who are considering selling may want to list their homes soon to avoid potential price declines.

The U.S. housing market slowed considerably in the spring with 5.5%-plus mortgage rates, sending many buyers to sidelines and cooking competition. With the market already slowing from its pandemic peak. We analyze which metros are most susceptible to home price declines if the country officially enters a recession and which are most resilient to an economic downturn.”

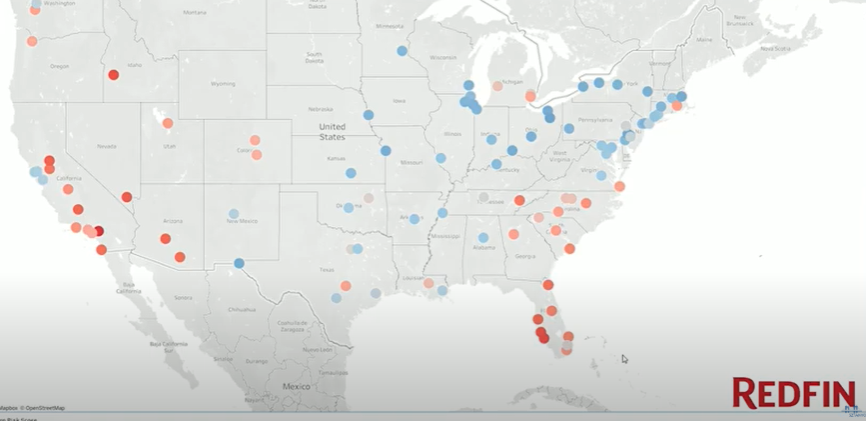

So I know as I’ve talked to many of you around the country, you’re feeling a little bit more of that cooling in your cities than we are here in Cincinnati. And it’s just because again, we didn’t see that huge soaring price increase during the pandemic. Probably as much as some of your other cities, you can scroll down here and look at this map on the Redfin article. And you can see it’s mostly these coastal cities and in the Sunbelt where you’re seeing a much higher risk.

So in Florida, some in Texas, but definitely in Arizona and California, you’re seeing that risk and where you see cities and areas with recession proof and less risk of that downturn is more in that Sunbelt area. So you can look at these cities that were named Cincinnati with 32.5, 8% Columbus, 34% Akron, 29%, Buffalo, New York, 33%. These are areas where the housing market didn’t store quite as much. So if a downturn comes, there’s not quite as much risk.

Help in Real Estate Planning With Team Sztanyo

I hope this was helpful for you. I want to continue to bring as much market data to you as possible. So you can get a feel for the market. I’m not a professional economist or anything like that. I’m just a simple realtor who helps people buy and sell houses. And I flip houses in the area, but I don’t think it takes a rocket science to think through, Hey, you wanna sell high? You wanna buy low, right? We’re already maybe on the edge of thinking to sell because you’ve seen all this appreciation over the last few years. This might be that tipping point where you say, Hey, it’s time to sell the house. Maybe move to an area where we can buy a little bit cheaper for now. If there’s gonna be a downturn coming

So is Cincinnati recession proof? No. I mean, if there’s another great recession or anything that big, every city’s gonna feel it, you can’t bank on going to any city and say, if there’s a downturn nationally, it’s not gonna affect you, but you can look at this data and kind of say, okay, if there’s a downturn and prices go down in these cities, in these areas, maybe the downturn is gonna be felt less than in some of these other markets that have been hot, hot, hot, and are poised to go down a lot. So that’s what you need to kind of think through as you’re considering is Cincinnati or any other city recession proof or not.

If you guys are looking to move to Cincinnati or Northern Kentucky area, we would love to be your realtor of choice. If you’re moving somewhere else, give us a call. We can still refer you to a great agent in that area. Thanks so much and we’ll see you next time.