Hey guys, welcome back! It’s Eric Sztanyo from Keller Williams Realty and TeamSztanyo.com where we are helping families find their way home. I want to talk about something near and dear to my heart, which is investing in real estate. While many of you know that I am a real estate agent with Keller Williams, I am also a real estate investor and cash homebuyer. Because of this, many young people who are looking into investing in real estate ask me “when is the right time to invest? Does investing in real estate even make sense for someone in their 20’s or 30’s?”. The answer is simple, ABSOLUTELY YES!! If you are interested in how investing in real estate in your 20’s or 30’s could earn you THOUSANDS of dollars, check out this video.

Why Investing in Real Estate Young is Smart

As a young person or young couple, investing in real estate may seem intimidating. The best place to start your investing journey is in your very own home. What I mean by this is instead of throwing money on rent at some overpriced apartment, go and buy A DUPLEX!

A duplex, or multi family home, is a home that can comfortably house two or more families. The idea behind this is that if buy a duplex and occupy one of the units yourself, you could then rent the other unit out to a tenant. By doing this, the tenant is now paying your mortgage and you are able to live rent free. I like to call this little trick, house hacking! House hacking is a GREAT place to start your investing journey.

So, let’s take this one step further. Now that you are living practically rent free, what are you going to do with all of the extra money that you are saving? My suggestion is to save up and buy ANOTHER investment property. Now, not only are you living rent free but you also have the tenants from your new property paying their rent every month. This could equate to hundreds of extra dollars every single month. This concept creates a snowball effect where the more money you that is coming in, the more investing you can do and ultimately, the more money you can make.

Rich Dad, Poor Dad

There is a book that I highly recommend to anyone who is interested in success called Rich Dad, Poor Dad. The basic idea of the book is that you want to buy assets rather than liabilities. The difference between the two is that liabilities are things that take money from your pocket and does not make any money on its own. On the other hand, assets are things that may initially take money from your pocket but have the ability to put money back into your pockets in the long run. Examples of assets would be stocks, mutual funds, or even real estate.

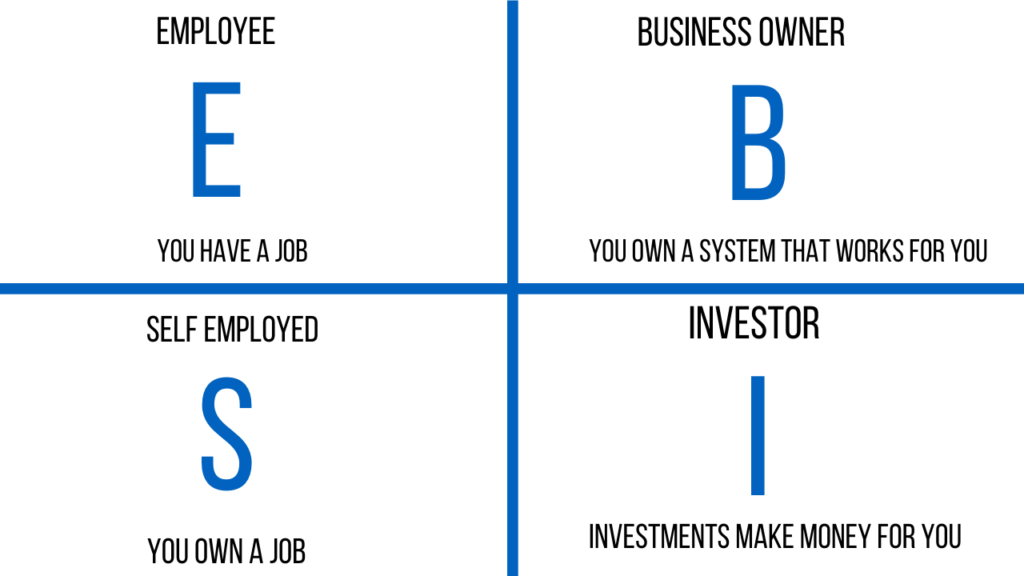

The same author, Robert Kiyosaki, also wrote a book called The Cash Flow Quadrants. This book breaks down the four ways that Kiyosaki says that you can make money. The first way is to be an employee, this is where you solely work for someone else. The second way is to be self employed, this means that you essentially own your job. The third option is to be a business owner, this is where you own a system. Lastly, your fourth option, is to become an investor which is where your investments make money for you.

I don’t know about you, but my goal is to move over to the right side of this chart, where my investments are actually bringing in money. So the question now is, how? How does that work for real estate? Well, there are four ways that investing in real estate can make you money.

Cash Flow

When investing in real estate, it is important to know that each unit is referred to as a door. So, in a duplex you may have two doors that are tenant occupied. If you are charging each tenant $1200 a month but the mortgage of the rental property as a whole costs you $1200 per month, you are now cash flowing roughly $1200 a month off of those two tenants alone. Of course, there are other expenses that you will have to take into consideration, but you see the point. If you think about this on a larger scale, you could be bringing in thousands of dollars each month just off of your investments.

Taxes

Another way you can make money when investing in real estate is by saving on your taxes. There are incredible benefits when investing in real estate where you can write off the the interest on taxes. Along with this, you can also roll the taxes from one property into another property, which will delay taxes until a later date.

There are several great tax advantages that go hand in hand with real estate. There’s a reason that real state is the number one wealth builder of people in America, and has been for hundreds of years. Tax advantages are only one of the ways that real estate investing could make you money.

Appreciation

Often times, when you buy a property, it will appreciate over the years. This means that after you buy the property, the market goes up along with the value of your home. Let’s say that you bought a home for $100,000 and keep this home for 10 years. When you go to sell the home 10 years later, you sell for $150,000. What happened? Well, equity happened! The market rose and the property value rose with it and you made $50,000 just by simply owning the property!

Amortization

The next way that real estate investing could make you more money is amortization of your home loan. So, when you have a tenant in your property, they are paying you their rent each month. Hopefully, you are then taking some of that rent money and paying down your mortgage. Let’s say that you have a 30 year fixed loan, you are paying down your mortgage every single month. Along with this, you are also paying off interest and a little bit of principle on the property. With every little bit of principal you pay, the more of the house you own and your equity is growing.

As an example, let’s say that you bought a home for $100,000. Now, ten years later, you only owe $75,000 on the home and you sell the home for $150,000. Not only are you earning $50,000 from the appreciation of the home but also the additional $25,000 that you have paid down on the loan in the last ten years.

Why Now?!

So, I love real estate and I think you would too! There are so many options and so many ways to make money. There are three main reasons why you should start investing in real estate early, before you have kids or a large family. Reason #1. is that house hacking is much easier to do before you have several children running around. I’m not sure if you have ever tried to move with 4 kids running about but let me tell you, it is NOT a good time.

Another reason that I recommended investing early is so that you can begin building your assets sooner. This will build more momentum and in the long run, give you the ability to buy more assets sooner. This goes with the snowball effect that i mentioned earlier, once you see the money coming in, you want to buy more and more investments.

Lastly, the reason that I suggest beginning to invest now, is so that you have time to perfect your trade. Like most things, real estate investing takes time to master. You WILL hit bumps along the way, and that’s okay. However, starting young gives you the necessary time and experience to learn the ins and outs of investing in real estate.

The first time that I purchased a multi-family home, I partnered with someone who had been in the business for 15 years. He helped me to pick out a great property in Fort Wright and actually is still the property manager there. With his help, along with the experience that I have gotten throughout the years, I have had time to improve and perfect my business.

Educate Yourself!

Overall, investing in real estate at a young age is a fantastic idea. Educate yourself, read books, and use the wisdom of people who have done it before you. There so many free sources that can give you insight on investing in real estate. Just be sure not to over analyze too much, where you never act on your intention to actually invest. I call this analysis paralysis.

If you are ready to get started on your nivesting journey and need some help, Eric at Team Sztanyo would love to give you some insight. Give us a call today at (513) 813-6293, thanks so much for stopping by!